Builders Report Weak Demand, Continue to Moderate Pricing

October 20, 2022

The latest State of the Industry Report, compiled with BTIG, indicates September demand trends were at the weakest they’ve been in the nearly five-year history of the survey. Both sales and traffic readings were at survey-record lows.

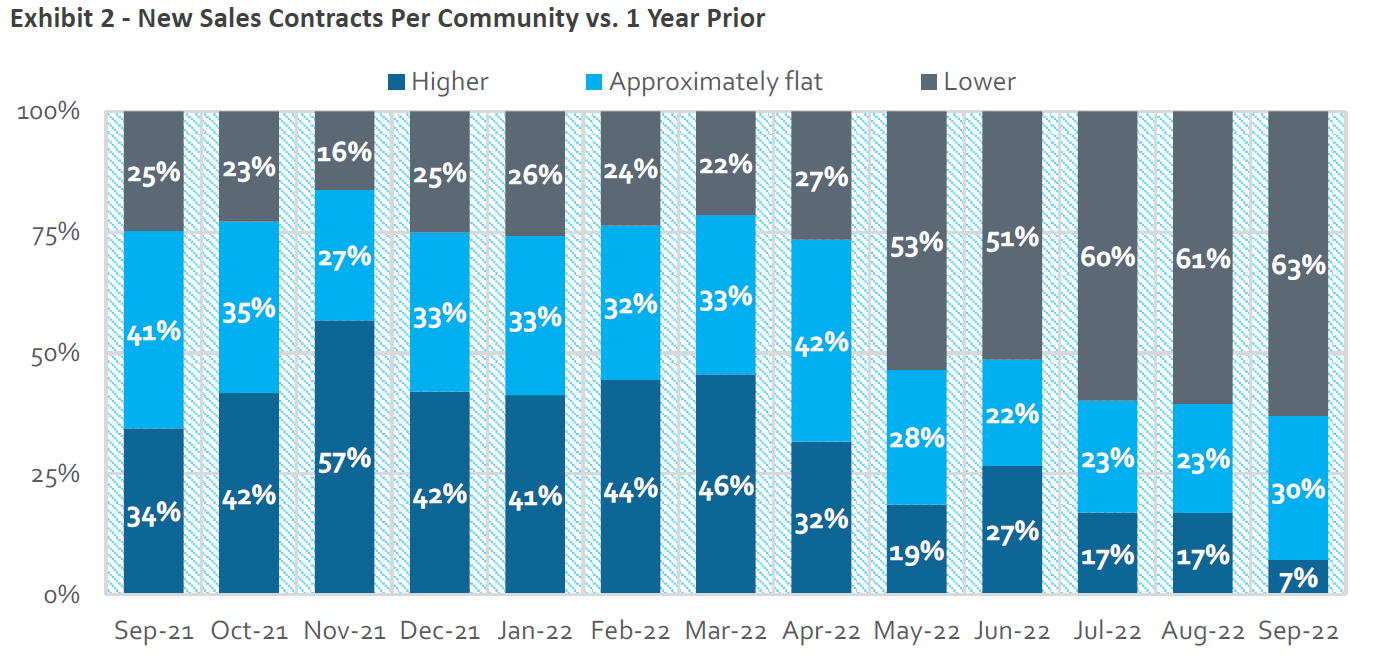

Broken down, sales continued to decrease in September, with 63% of builder respondents reporting year-over-year decreases in sales.

Meanwhile, just 12% of builders reported year-over-year traffic increases, while 61% saw year-over-year declines, which compares to 53% for August.

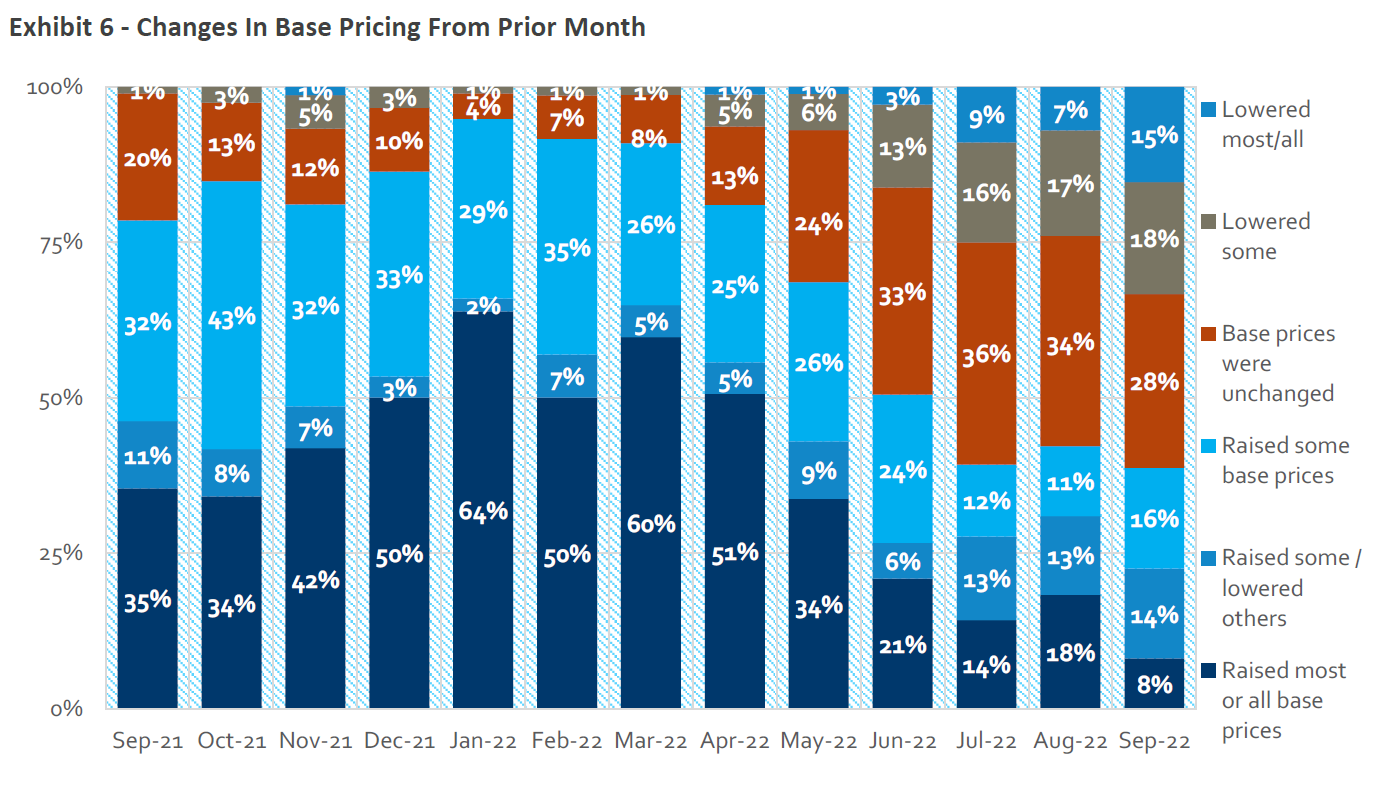

To combat weakened demand, builders continue to moderate pricing activity while increasing sales incentives. In September, 47% of builders lowered some base prices compared to 37% for August, while 44% increased sales incentives on at least some homes, compared to 38% for August.

As stated in the report, business conditions are worsening, likely due to higher mortgage rates, the fear of falling real estate values and weaker economic conditions among consumers and a lag in some builder reactions to negative conditions. Seasonality is also likely part of it, to some extent.

The report reflects home builder sentiment, with the latest NAHB/Wells Fargo Housing Market Index coming in at 38 — an eight-point drop from September.

BTIG’s Carl Reichardt Jr. recently spoke about overall market trends at the 2022 HomeSphere Partner Summit, comparing today’s housing market with that of a postwar economy. Today, the war is COVID, where we saw homes became “fortresses” that protected the populace and economic resources were redirected to fight the pandemic, disrupting supply chains. During the “war” and “postwar,” a positive snap in demand was met with a substantial reduction in the ability to meet it. Similar results, like inflation, were seen following both World War One and World War Two.

More insights from his presentation is available in this post.

Highlights from the latest State of the Industry Report

Sales and traffic trends weakest in survey history: Only 7% of builders reported higher year-over-year sales versus 17% for August and 34% in September 2021. 63% saw a year-over-year decrease in orders versus 61% for August and 25% in September 2021. Only 12% reported an increase in year-over-year traffic versus 17% for August, while 61% saw a decline, compared to 53% the previous month.

Sales and traffic relative to expectations also continue to weaken. A survey record-low 10% of respondents saw sales as better than expected, while a survey-record high 48% saw sales as worse than expected. Just 13% saw better-than-expected traffic, with 40% seeing worse-than-expected traffic.

The number of builders raising prices decreased slightly, while sales incentive use continued to increase. 24% of builders raised some, most or all base prices in September, down from 29% for August. Meanwhile, 33% cut some, most or all base prices versus 24% in August. 34% of builders increased "most/ all" or "some" incentives versus 31% for August.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: