Demand Trends Still Soft, Some Materials Reportedly Easier To Obtain

September 16, 2022

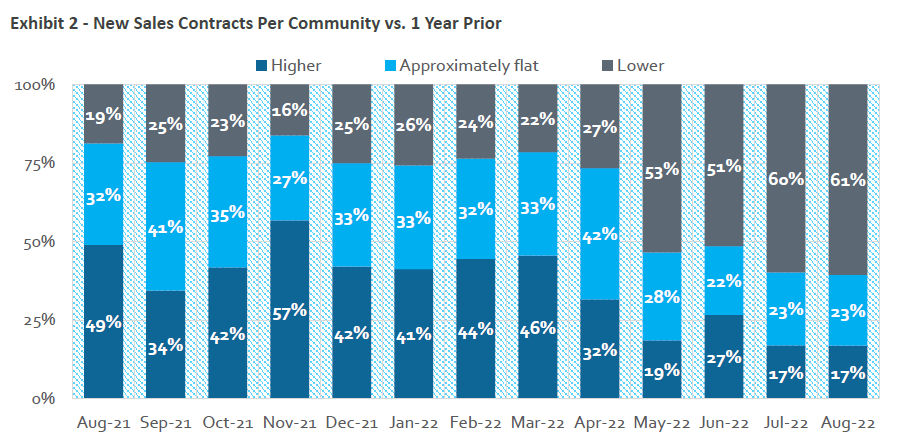

Home builders are still seeing softened demand trends in our latest State of the Industry Report, compiled with BTIG. In this month’s survey, 17% of builders reported year-over-year increases in sales orders per community in August, while 61% reported a decline.

The trends were strikingly similar to July:

As stated in the report, it’s likely the results are due to both higher rates and higher home prices, as well as negative consumer psychology about real estate values and, potentially, the economy.

In a special question, builders were also asked about which building materials have become easier to obtain and/or less expensive than a year ago. See more details in the summary below, but “nothing” was a fairly popular answer.

Based on the data, it's likely the Wells Fargo/NAHB Housing Market index is likely to come in near the current Factset consensus expectation of 49 (prior month reading was 49).

Highlights from the latest State of the Industry Report

Sales and traffic remain weak. 17% of respondents reported year-over-year increases in sales orders per community compared to 17% for July and 49% in August 2021. 61% saw a year-over-year decrease in orders compared to 60% for July and 19% for the same month last year. 17% reported an increase in year-over-year traffic at communities while 53% saw a decline. This compares to 16% and 58%, respectively, for July. Our sales reading remains at a survey-record low, while traffic is the third worst reading of all time behind July and the pandemic shutdown-impacted April 2020.

Sales and traffic performance relative to internal expectations are also weak. Sales and traffic relative to expectations continue to be soft and the better-minus worse ratio for both indicators remains negative. 14% of respondents saw sales as better than expected while 43% saw sales as worse than expected. A survey record-low 11% of builders saw traffic as better than expected, while 31% of builders saw traffic as worse than expected (14% and 42%, respectively, for July).

More base price cuts and sales incentives higher than earlier in 2022, though not worse than July. The number of builders raising prices did pick up slightly from July, while the use of sales incentives was relatively in-line with July. 29% of builders raised "most/all" or "some" base prices in August from July, up from 26% for July. 24% cut some, most or all base prices compared to 25% in July. 31% of builders increased "most/all" or "some" incentives compared to 33% for July.

Lumber and windows are cheaper and easier to come by compared to a year ago. We asked builders a special question about which building materials have become easier to obtain and/or less expensive than a year ago. Anecdotal responses varied quite a bit, but of the three most popular answers, over half of respondents noted that lumber was less expensive and/or more available, while 21% answered "windows" and 21% responded that "nothing" had improved.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the research firm BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: