Home Builders: Demand Trends Declined from April

June 14, 2022

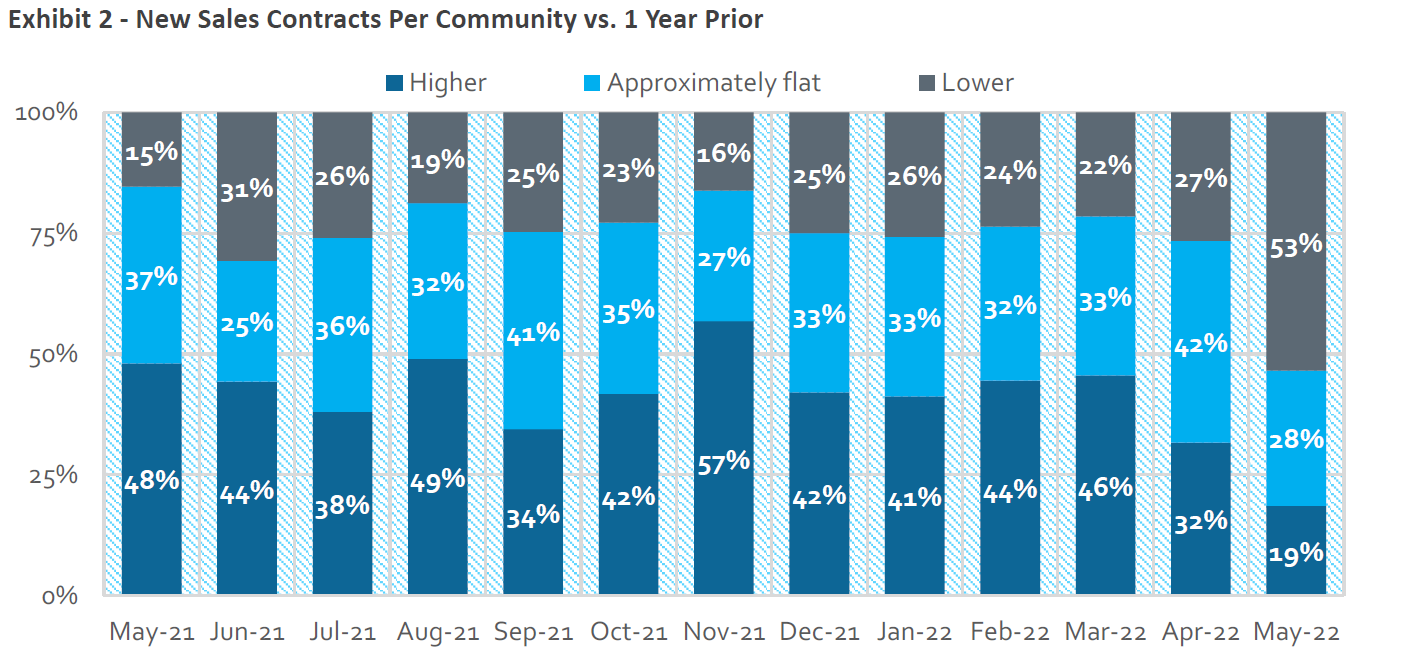

Demand trends continued to decline in May according to builder feedback to HomeSphere’s latest State of the Industry Report, compiled with BTIG. Nineteen percent of builders indicated that they experienced a year-over-year increase in sales in May, which is the poorest reading in the survey’s 56-month history.

That leaves 53% of builders who reported a year-over-year decline (and 28% who reported an approximately flat difference).

It's likely the move lower can be attributed to both higher rates and higher home prices, as well as negative consumer psychology about real estate values and, potentially, the economy. However, it's important to note that some builders continue to purposely slow orders to match sales with production capacity given a difficult supply chain environment.

For the second consecutive month, builders also reported fewer year-over-year increases in traffic, with 20% reporting traffic growth, the lowest level since the start of the pandemic. Meanwhile, 33% of builders saw year-over-year traffic growth.

It’s likely demand will remain low absent lower interest rates, and BTIG analysts estimate that the NAHB/Wells Fargo Housing Market Index will come in below the Factset consensus of 68.

Highlights from the latest State of the Industry Report

Sales. Sales dropped in May, with only 19% of respondents reporting year-over-year increases in sales versus 32% in April and 48% in May 2021.

Traffic. Positive traffic trends slowed. Additionally, 43% of builders saw a decline in year-over-year traffic compared to 27% in April.

Expectations. Sales and traffic relative to expectations fell sharply, and the better-minus-worse expectations ratio for both flipped negative this month. 15% of respondents saw sales better than expected versus 20% last month, while 34% saw sales as worse than expected. Just 19% saw better traffic than expected versus 28% in April 2022, while 28% of builders saw traffic as worse than expected (22% last month).

Pricing and incentives. 60% of builders raised some, most or all base prices in May, down from 76% last month and the peak of 100% in May 2021. Incentive use increased slightly with 16% of builders increasing "most/all" or "some" incentives compared to 9% for April.

Cancellation Rates. For the second consecutive month, builders were asked about order cancellation rates. 67% of builders reported that cancellations rates remained constant. Only 6% reported seeing “significantly higher” cancellation rates.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the research firm BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: