Demand Trends Slow as Challenges Catch Up to Home Builders

May 24, 2022

Demand trends slowed significantly last month according to builder feedback from the latest State of the Industry Report, compiled with BTIG. Fewer builders reported year-over-year increases in sales and traffic than in any monthly survey since April 2020, the beginning of the COVID-19 pandemic.

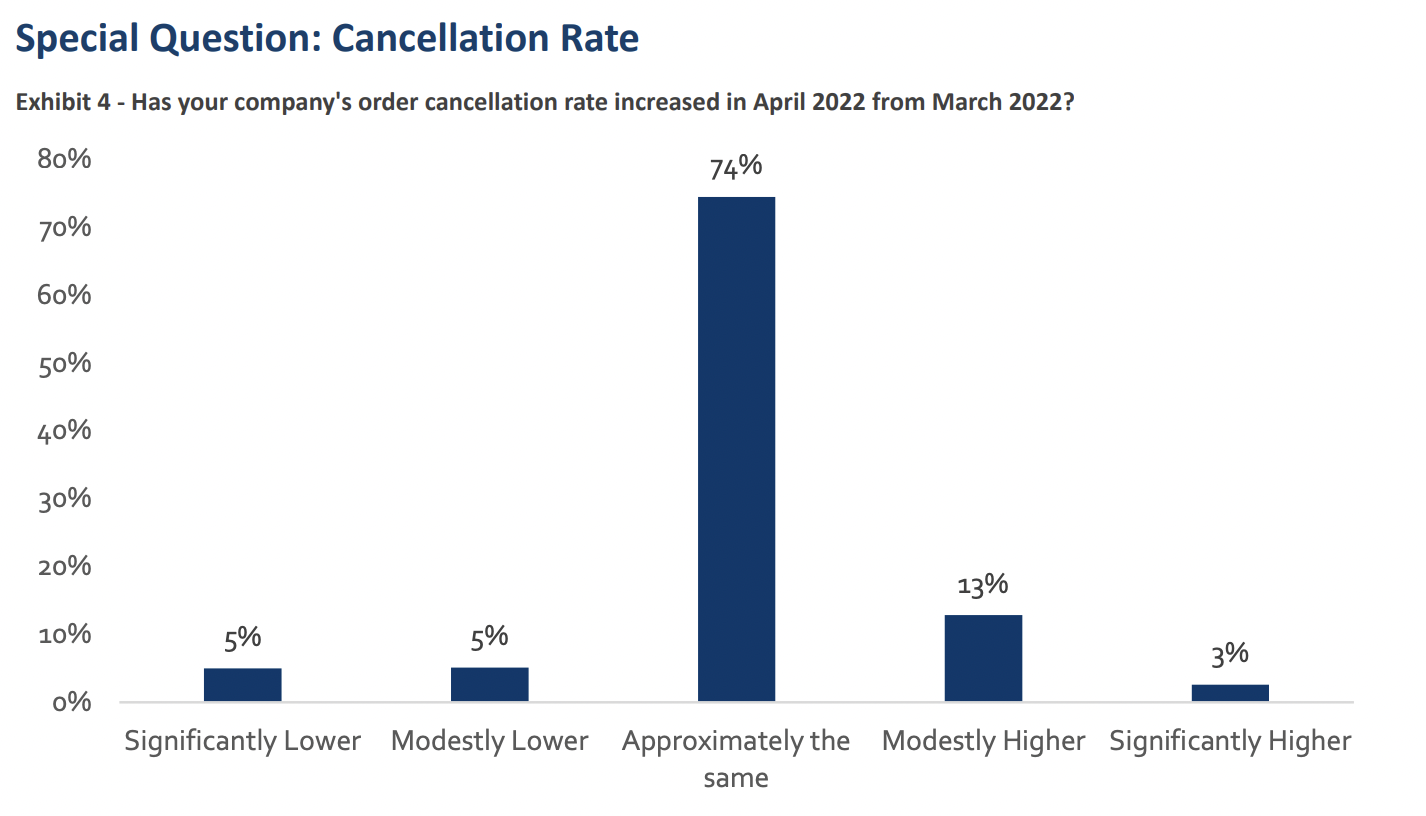

Both sales and traffic relative to expectations saw a sizable drop off. However, in a special question, builders indicated that cancellation rates have yet to significantly increase.

While builders continue to benefit from a short supply environment, BTIG analyst Carl Reichardt Jr. anticipates that demand will continue to ease in the coming months if rates remain high. Easing demand is also likely due to aggressive pricing activity starting in 2020 and consumers losing confidence in recent months.

Reichardt posited that the NAHB Housing Market index, which came out May 17, was likely to come in lower than the current Factset consensus expectation of 75, possibly significantly. The index came in at 69.

Highlights from the latest State of the Industry Report

Sales. Sales dropped in April, with 32% of respondents reporting year-over-year increases in sales compared to 46% in March and 72% in April 2021.

Traffic. Traffic trends slowed considerably, with 33% reporting an increase in year-over-year traffic compared to 44% for March and 76% in April 2021.

Expectations. Sales and traffic relative to expectations fell sharply. 20% of respondents saw sales better than expected compared to 34% for March. Just 28% saw better traffic than expected versus 38% in March 2022 and 56% last year. The better-minus-worse expectations ratio for both indicators continues to be positive, but the gap narrowed significantly in April.

Pricing and incentives. 76% of builders raised some, most or all base prices in April, down from 86% for March and the peak of 100% in May 2021. Incentive use remains low with only 9% of builders increasing most, all or some incentives compared to 8% for March and 13% in April 2021.

Cancellation Rates. A special question was asked regarding order cancellation rates. Thus far, builders have yet to see a significant change with 74% of builders seeing approximately the same cancellation rate in April as in March. Only 16% reported seeing “modestly or significantly higher” cancellation rates.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the research firm BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: