[Watch] The New Abnormal: An Unprecedented Housing Cycle in 2022

March 24, 2022

Earlier this month, Carl Reichardt Jr., managing director and home building analyst at the global investment bank BTIG, joined us for a discussion on the 2022 housing market, and the most consistent word to describe these unprecedented times remained abnormal.

What does that mean?

The 2022 housing market in a nutshell

Well, there are five key sticking points defining the times:

- Home prices. The S&P CoreLogic Case-Shiller Home Price is at an all-time high. In fact, home prices soared almost 19% in 2021.

- Low population growth. The population in the U.S. in 2021 had the lowest growth in history — 0.1%.

- Homeowner vacancy. Meanwhile, the homeowner vacancy rate is tied for the lowest ever at 0.9%.

- Home inventory levels. Continuing the trend, housing inventory levels are the lowest ever for existing homes.

- Pessimistic consumers. Finally, data shows consumers haven’t been this pessimistic about housing since 1983.

And when they all come together, Reichardt says, you’re left with a “frozen” existing housing market — a market so cool, it’s hot.

Watch “The New Abnormal” with Carl Reichardt Jr.

Go beyond the snippets here. See Reichardt’s full discussion in our free, on-demand webinar. He dives into the spring selling season, what builders large and small are saying and emerging trends in the residential new construction industry.

According to recent numbers compiled by the Census Bureau and BTIG, there are fewer than 1-in-100 single-family units vacant and for sale in the country. That equals about 840,000 units, down 39% from the second quarter of 2005, or the peak of the demand bubble — despite having 18.6 million more housing units today.

'We’re so frozen from a supply standpoint, we’re creating anomalies in data points we’ve never seen,” Reichardt said.

While the conditions provide home builders with a huge opportunity, it’s not as simple thanks to supply chain constraints, extended building and lot development times and the need to restrict sales despite incredible demand.

Reichardt estimates that 50% of public builders are still restricting sales in approximately 50% of their communities.

Still, permits are increasing and Reichardt expects to see 12% community count growth for public builders in 2022.

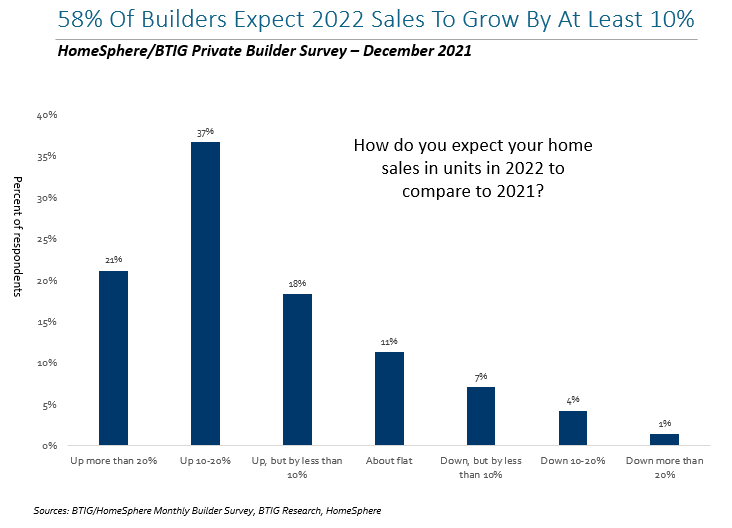

Private builders, surveyed by BTIG and HomeSphere, suggested their 2022 sales will grow by at least 10% this year, with 21% believing they’ll grow by more than 20%.

Residential construction trends to watch in 2022 and beyond

As these conditions play out, Reichardt dove into the biggest trends to watch: increased interest in single-family rental and continued work-from-home policies post-COVID.

Single-family rental: Watch out for the institutionalization and expansion of “ma and pa” operations. Reichardt says we could also see a new permanent “B2B” channel for builders with long-term thin inventories, higher land prices and greater interest rate sensitivity. Single-family rentals could also become a long-term competitor to entry-level products.

Post-COVID work-from-home routines: Watch out for home prices and affordability to become “national” if middle-class and upper-class white-collar workers can work from home permanently. It’s possible we’ll also see tertiary market growth, and growth in ex-urban location land value as well as growth in home size.

Additional trends:

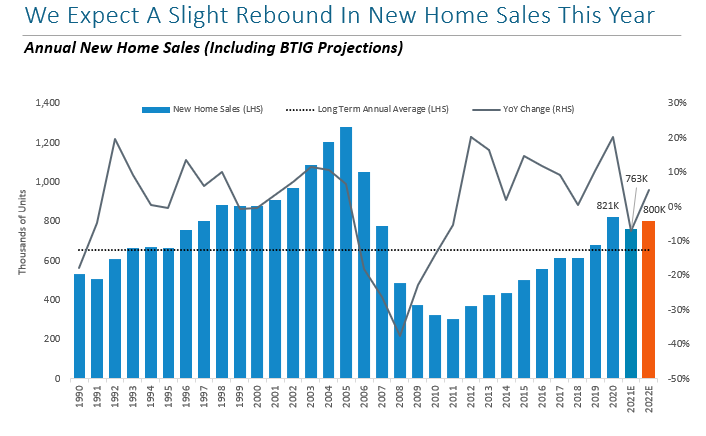

- Reichardt and BTIG estimate that there will be a slight rebound in new home sales, increasing from 763,000 in 2021 to 800,000.

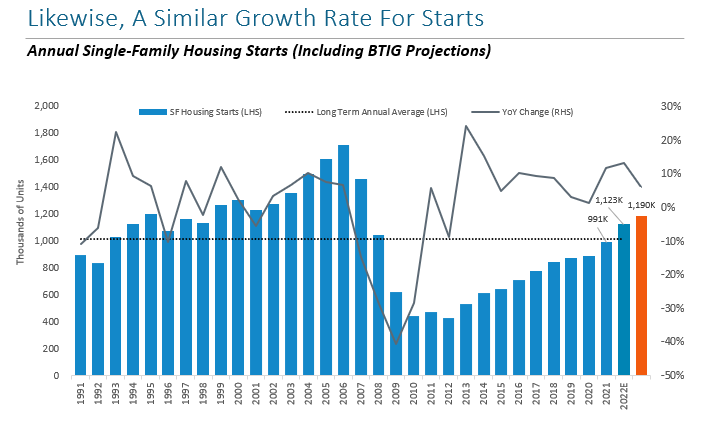

- BTIG also projects a similar growth for single-family housing starts, increasing from 991,000 in 2021 to 1.19 million in 2022.

- 2022 will likely not see significant improvement from 2021’s supply chain.

Want more expertise from Reichardt and BTIG?

Check out our monthly State of the Industry Reports, compiled with BTIG. The report offers the perspective of small-to-medium sized home builders who take part in the HomeSphere program.