Home Builders Report Lowering Prices and Increasing Incentive Use

August 12, 2022

Demand trends continued to weaken in July, with 60% of home builders reporting a decline in sales orders, according to the latest State of the Industry report, compiled with BTIG. Only 17% of builders reported year-over-year increases in sales orders.

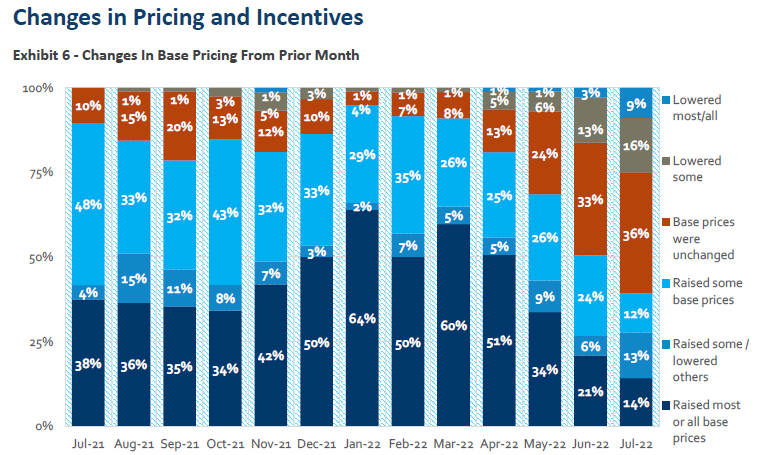

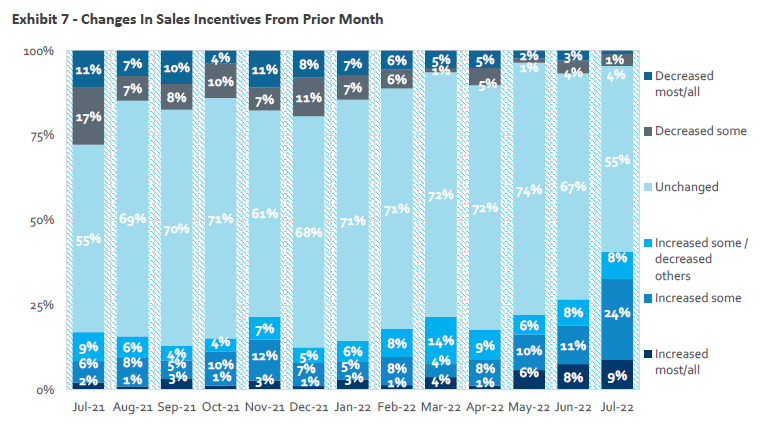

In response to softening demand, more builders reported cutting prices and increasing sales incentives, with 38% lowering at least some base prices compared to 22% for June. Meanwhile, 41% of builders increased sales incentives compared to 27% for June.

Interestingly, while this report typically doesn’t draw regional conclusions, respondents (113 in total this month) were particularly negative in the Pacific northwest, while the south and Pennsylvania showed some relative strength.

Based on responses, it’s likely the NAHB/Wells Fargo Housing Market Index will come in below the current Factset consensus expectation of 53.

Highlights from the latest State of the Industry Report

Sales and traffic at survey-record lows. 17% of respondents reported year-over-year increases in sales orders per community versus 27% for June and 38% in July 2021. 60% saw a year-over-year decrease in orders versus 51% for June and 26% for the same month last year. 16% reported an increase in year-over-year traffic at communities, while 58% saw a decline. This compares to 24% and 50%, respectively, for June.

Sales and traffic performance relative to internal expectations also weak. Sales and traffic relative to expectations continue to be soft and the better-minus-worse ratio for both indicators remains negative. 15% of respondents saw sales as better than expected while 39% saw sales as worse than expected. For June, 11% of respondents saw sales better than expectations and 37% saw them as worse. A survey record-low (tied with June) 14% of builders saw traffic as better than expected, while 42% of builders saw traffic as worse than expected (27% for June).

Base prices moving lower and incentives picking up. The number of builders raising prices decreased in July while the use of sales incentives picked up from June. 26% of builders raised some, most, or all base prices in July from June. This is down from 45% for June and 86% last July. A further 13% raised some bases, but lowered others. 33% of builders increased "most/all" or "some" incentives versus 19% for June and 8% last year.

Geography: weakest in Pacific northwest; relative strength in the southeast. While weakness was widespread, there were particularly negative responses from the Pacific northwest (Washington, Idaho, Utah and Oregon) as well as Minnesota. Positive conditions were reported with far less frequency and also quite scattered, but the south (Texas, Georgia, Florida and South Carolina) as well as Pennsylvania saw some relative strength.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the research firm BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: