Builders Adjust Pricing in June, Cancellation Rates Overall Unaffected

July 14, 2022

Home builders continued to report softening demand trends in June, according to the latest State of the Industry Report, compiled with BTIG. While 27% of builders reported year-over-year increases in sales orders, 51% reported year-over-year declines, with similar results for year-over-year traffic.

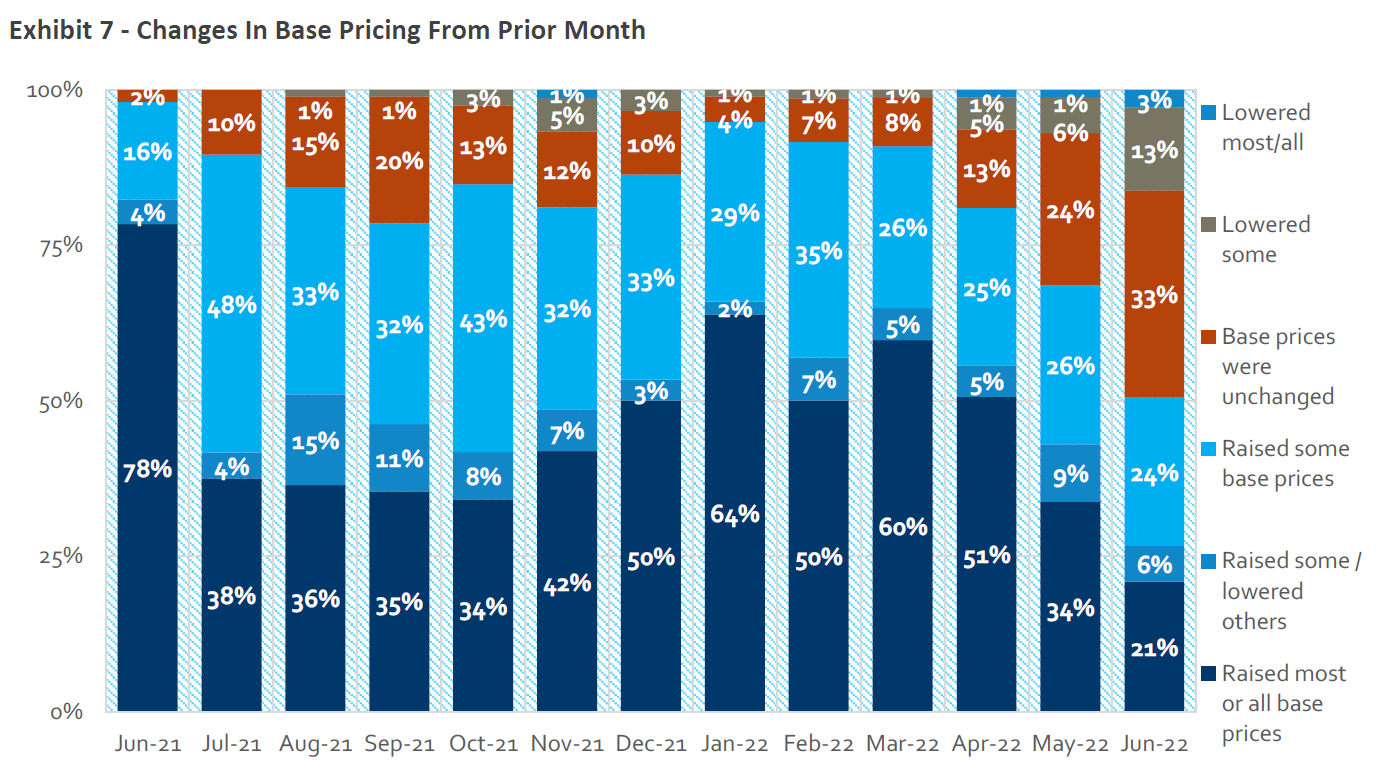

Notably, more builders reported lower or flat base prices than increases, month over month, for the first time since June 2020. While 45% of builders increased asking prices, 49% kept their prices flat or lowered them.

Incentive use also picked up in June, but modestly, with 19% of respondents reporting that they increased “most/all” or “some” incentives compared to 16% for May.

Cancellation rates, however, have not increased significantly, with 67% of builders reporting rates in June as approximately the same as May.

Based on survey data and anecdotal public builder commentary, BTIG analysts believe the Wells Fargo/NAHB Housing Market index gauging builder sentiment, to be released on July 18, may come in lower than the current Factset consensus expectation of 66. The prior month reading was 67.

Highlights from the latest State of the Industry Report

Sales. The number of builders reporting higher year-over-year sales and traffic increased slightly in June, but readings remain at low levels. 27% of respondents reported year-over-year increases in sales orders per community versus 19% for May and 44% in June 2021.

Traffic. 51% saw a year-over-year decrease in orders versus 53% for May and 31% for the same month last year. 24% reported an increase in year-over-year traffic at communities, while 50% saw a decline. This compares to 20% and 43%, respectively, for May.

Expectations. Sales and traffic relative to expectations continue to fall, and the better-minus-worse ratio for both indicators remains negative. A survey record low 11% of respondents saw sales as better than expected while 37% saw sales as worse than expected. A survey record low 14% of builders saw traffic as better than expected (19% last month), while 27% of builders saw traffic as worse than expected (28% last month).

Pricing and incentives. The number of builders raising prices decreased in June while the use of sales incentives picked up slightly from May. 45% of builders raised some, most, or all base prices in June from May. This is down from 60% for May and 94% last June.

Cancellation Rates. Builders have yet to see a significant change. The number of builders raising prices decreased in June while the use of sales incentives picked up slightly from May. 45% of builders raised some, most, or all base prices in June from May. This is down from 60% last month and 94% last June.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the research firm BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: