Housing Update: A Look at 2022 and Where We’re Headed Into 2023

November 10, 2022

In recent months, the housing industry has witnessed falling new home sales, decreased builder confidence and negative consumer attitudes toward buying a home. It leaves you wondering: where is the market headed from here?

Carl Reichardt Jr., managing director of homebuilding equity research at BTIG, addressed this question in a recent presentation to HomeSphere’s manufacturing partners during our 2022 Partner Summit. Highlights from his presentation are summarized below.

We’ve been here before (in some ways)

As Reichardt puts it, we’re witnessing a “post-war” economy, similar to that of post-World War I and World War II, but in this case the enemy is COVID.

In 2020, houses became the fortresses that protected us, while technology enabled us to continue working, which shined an entirely new light on what people wanted from their homes. Meanwhile, economic resources were redirected to fight the pandemic, which disrupted supply chains.

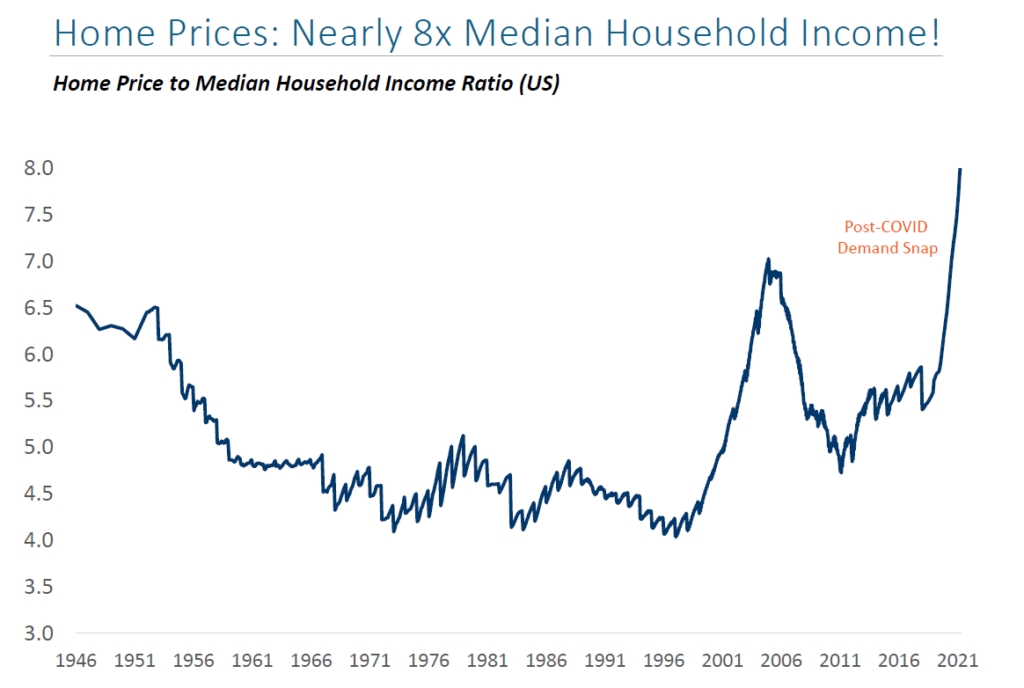

A positive snap in demand was met with a substantial reduction in the ability to meet it and we witnessed home prices accelerate tremendously — helped by low interest rates. Now, we’re seeing the Federal Reserve raising rates in a bid to temper inflation, which has helped to curb buyer enthusiasm.

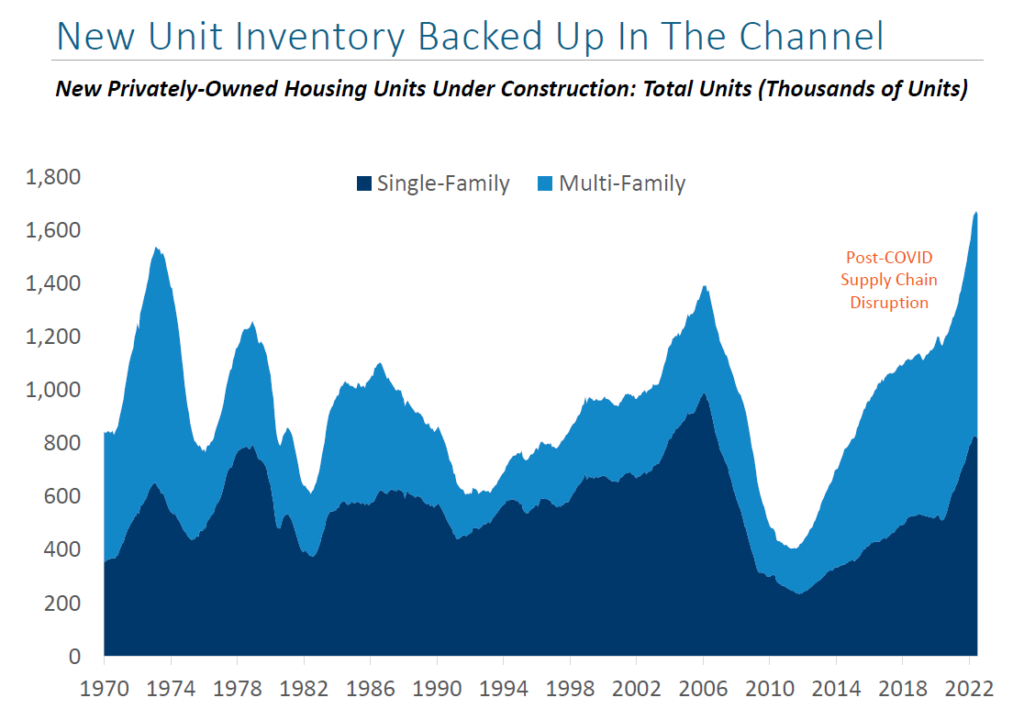

Builders report that supply chain disruptions and other constraints are keeping cycle times extended, while cancellations and prices cuts are forcing builders to re-price their backlog to keep it and maintain customer goodwill.

The builder response: price cuts and incentive usage

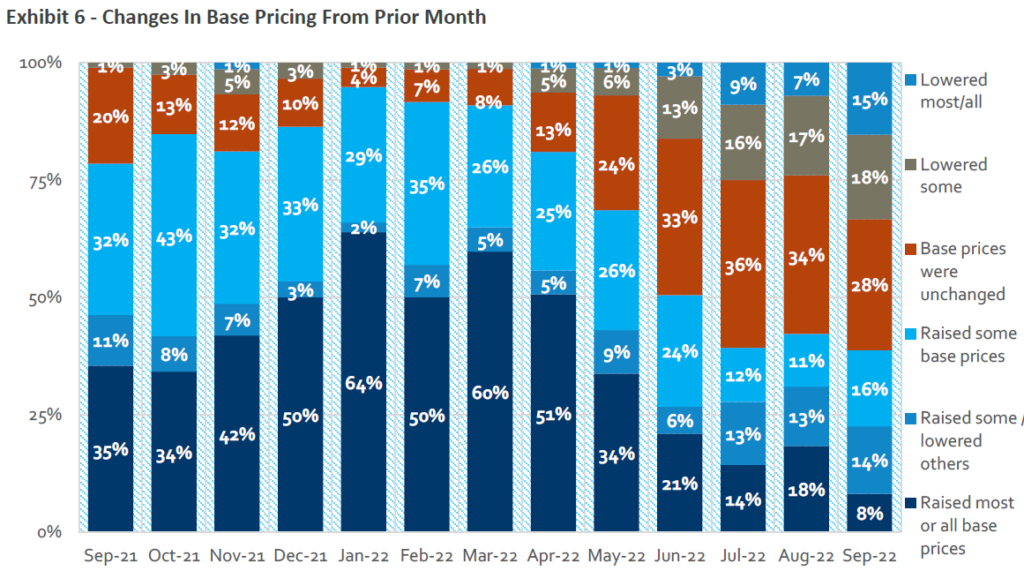

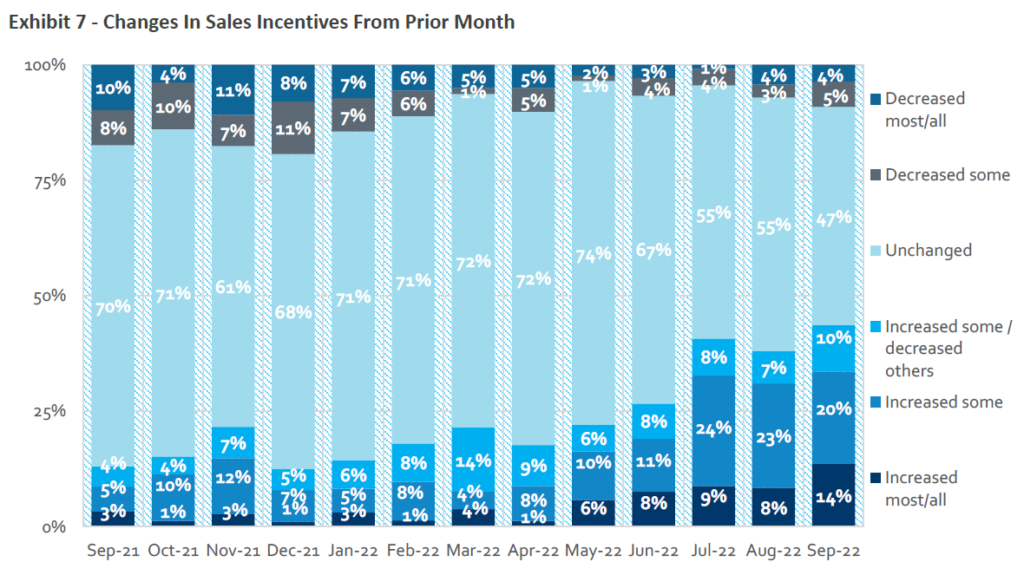

In response, a growing number of home builders are reporting price cuts, while increasing the use of incentives. This trend has been growing particularly since May.

Price data from the October HomeSphere/BTIG Industry Report:

Incentive data from the October HomeSphere/BTIG Industry Report:

A housing recession, but likely not a repeat of 2005

Housing recessions are typically defined as six or more months of consecutive year-over-year declines in new home sales, and there have been 10 since 1966 with an average duration of 15 months.

We’ve now seen six months of consecutive sales declines, but it’s not likely that we’re re-living 2005. That’s because:

1. The demographic picture is more favorable, with a growing pool of renters and buyers aged 20-39.

2. Mortgage lending criteria are much tighter and buyer credit much better.

3. Existing home inventory remains thin, in part thanks to “rate lock.”

4. The largest builders are much better capitalized.

So, what’s next?

It’s likely that builders will reduce the volume of starts in the next six to 12 months to clear under-construction inventory.

BTIG is forecasting 775,000 single-family housing starts in 2023 (down 23% from their 2022 forecast of 1 million), while single-family starts will grow 5% in 2024, up to 810,000 units.

For sales, BTIG is forecasting that new home sales will end 2022 at 635,000 units, and 545,000 in 2023, while they project a growth of 11% in 2024, up to 605,000 units.

In the short-term, Reichardt says to expect:

- More intense short term price drops in markets like Phoenix, Boise and Austin as work-from-home wanes a bit.

- Some signs the supply chain is normalizing, like lumber costs coming down and front-end trades becoming more available.

- Larger national builders gaining market share, especially at the low end.

And in the long run? It’s likely that housing will take more of a chunk out of people’s take-home pay as the industry grapples with affordability issues.

More from BTIG

BTIG is a global investment bank with over 700 employees and 19 locations in the U.S., Europe and Asia. HomeSphere has partnered with BTIG for more than half a decade to survey HomeSphere’s network of regional home builders about market conditions.

Find more builder insights and read our monthly industry report, conducted with BTIG, on our blog.