Home Building Trends Continue To Be Encouraging

March 25, 2024

In the latest HomeSphere/BTIG State of the Industry Report, private builders continue to report a better-than-typical seasonal uplift in business conditions.

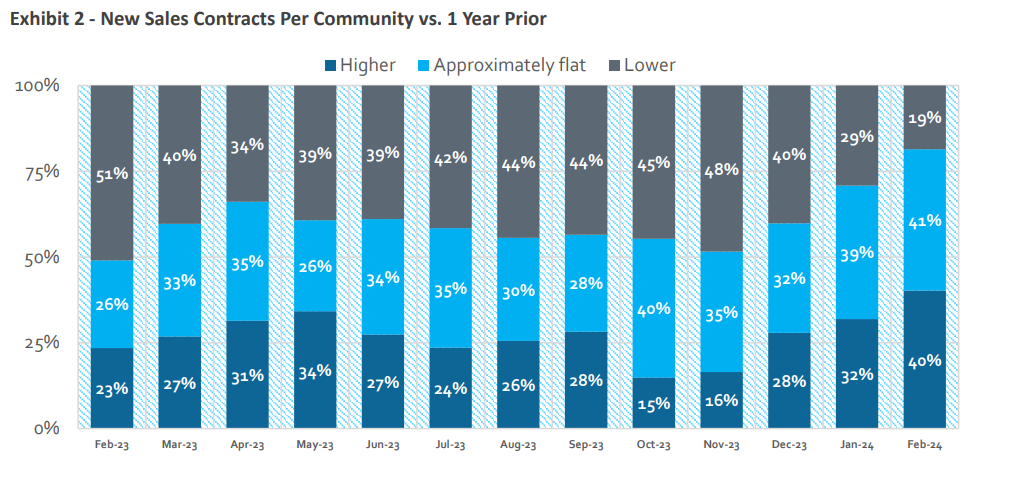

With the highest reading since March 2022, builders reported a 40% increase in orders, up from 32% last month. Traffic trends remained steady, with 41% of builders reporting year-over-year growth, compared to 40% last month — also the highest reading since March 2022.

Coupled with the lack of existing home inventory, business conditions are encouraging as builders head into the busy spring selling season.

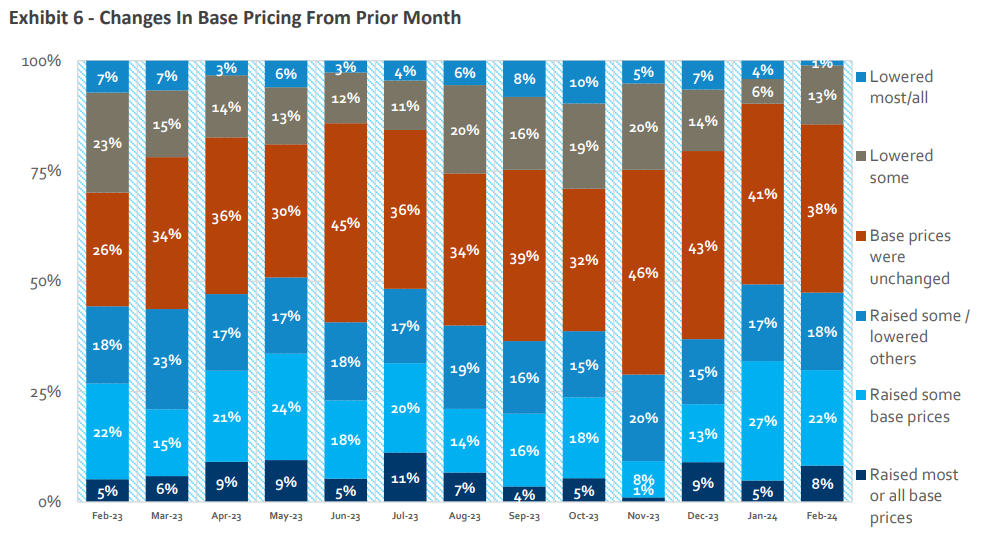

Meanwhile, pricing activity decreased in February. Incentive use remains mixed, and was generally fairly consistent for respondents throughout 2023, despite some aggressive incentive activity by their public peers.

The latest NAHB/Wells Fargo Housing Market Index (released March 18, 2024) came in at 51.

Highlights from the latest State of the Industry Report

February sales and traffic indicators improved over January. 40% of respondents reported yr/yr increases in sales orders per community vs. 32% last month and 23% in February 2023. 19% saw a yr/yr decrease in orders vs. 29% last month and 51% for the same month in 2023. 41% of builders reported an increase in yr/yr traffic at communities and 20% saw a decline vs. 40% and 26%, respectively, last month and 45% and 19%, respectively, in February 2023.

Sales and traffic performance relative to internal expectations was also stronger than January. 34% of respondents saw sales as better than expected; 13% saw sales as worse than expected (positive spread of +21). Last month, this spread was +10. 36% of builders saw traffic as better than expected, while 13% of builders saw traffic as worse than expected (positive spread of +23). This compares to 36% and 17%, respectively, last month (positive spread of +19).

Pricing and incentive activity shrank somewhat, but continues to be mixed. 30% of builders reported raising either "most/all" or "some" base prices vs. 32% last month. 14% lowered "most/all" or "some" base prices. 18% reported increasing "most/all" or "some" incentives vs. 21% last month, and 9% reported decreasing "most/all" or "some" incentives vs. 8% last month.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: