Improvement in Trends As Builders Prepare for Spring

January 18, 2024

In the latest HomeSphere/BTIG State of the Industry Report, private builders reported modest improvements compared to a weak fourth quarter in 2023.

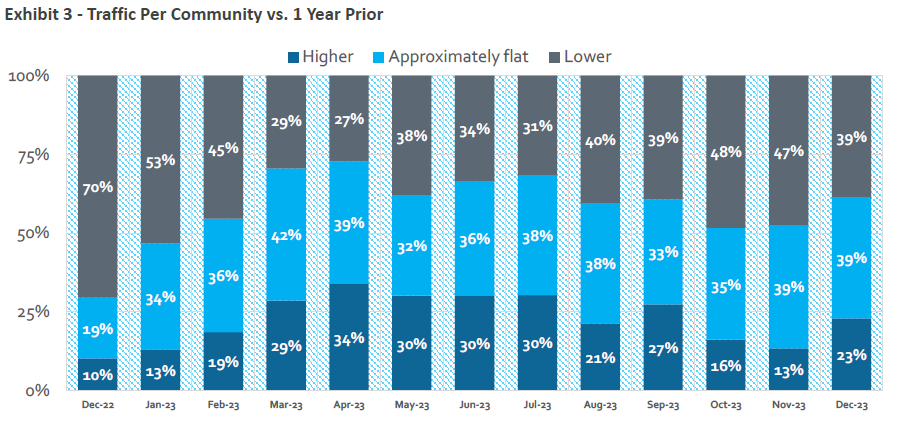

Builder expectations for a good spring selling season are optimistic. Sales trends increased 28% compared to 16% in November. Forty percent of builders reported a decrease, compared to 48% the previous month. More notable, traffic trends reported an increase of 23% from 13% in November and 10% a year ago. Thirty-nine percent saw a decrease versus 47% in November and 70% last year at this time.

Virtual sales tools have likely improved the overall quality of traffic builders are seeing. In addition, a spur in traffic may also be the result of increases in incentives and a slight decrease in rates.

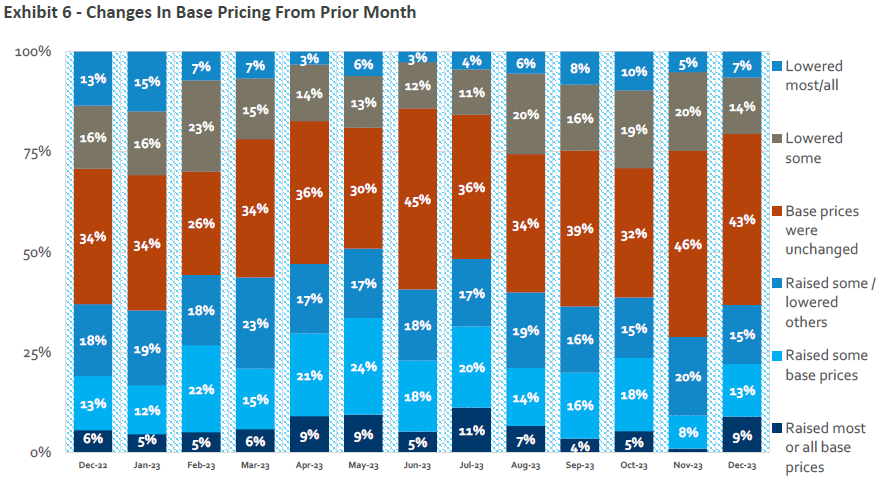

Back from an all time low last month, pricing activity improved. Twenty-two percent of builders reported raising prices, compared to 9% in November. Twenty-one percent reported decreasing prices, slightly lower than November at 25%.

Builders using incentives remains mixed, even with some aggressive incentive activity by public builders. Thirty percent reported increasing sales incentives in comparison to 26% in November. As reported by BTIG, builders will likely keep a careful eye on prices and incentives as they track traffic and buyer interest.

The latest NAHB/Wells Fargo Housing Market Index (released Jan. 17, 2024) came in at 44.

Highlights from the latest State of the Industry Report

December sales and traffic trends improved over November, and sharply from 2022. 28% of respondents reported yr/yr increases in sales orders per community vs. 16% last month and 7% in December 2022. 40% saw a yr/yr decrease in orders vs. 48% last month and 71% for the same month in 2022. 23% of builders reported an increase in yr/yr traffic at communities; 39% saw a decline vs. 13% and 47%, respectively, last month and 10% and 70%, respectively, in December 2022.

Sales performance relative to internal expectations was slightly better in December vs. November, but traffic looked better. 25% of respondents saw sales as better than expected; 31% saw sales as worse than expected (negative spread of -6). Last month, 19% of respondents saw sales better than expectations and 31% saw worse, for a negative spread of -12.24% of builders saw traffic as better than expected, while 20% of builders saw traffic as worse than expected (positive spread of +4, the first positive spread on traffic since July 2023). This is substantially improved from November (16% and 31%, respectively), a -15 spread.

Pricing action improved somewhat; incentives were slightly higher. 22% of builders reported raising either "most/all" or "some" base prices vs. 9% last month. 21% lowered "most/all" or "some" base prices, a bit better than the 25% reported in November. 30% reported increasing "most/all" or "some" incentives vs. 26% last month, and 6% reported decreasing "most/all" or "some" incentives vs. 8% last month.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: