Encouraging Trends As Builders Head Into the Spring Selling Season

February 20, 2024

In the latest HomeSphere/BTIG State of the Industry Report, private builders reported a better-than-typical-seasonal uplift in business conditions.

Builder trends showed encouraging results as year-over-year sales increased 32% compared to 28% in December. While positive signs for the industry, anecdotal builder commentary is still mixed, as available land and mortgage rates remain a concern.

On the bright side, traffic trends showed a significant uplift in January with 40% of builders reporting year-over-year growth in community traffic compared to 13% in January 2023. It was noted by BTIG that this has been the highest reading since March 2022.

Expectations showed continued growth in sales and traffic, leading to encouraging conditions for spring.

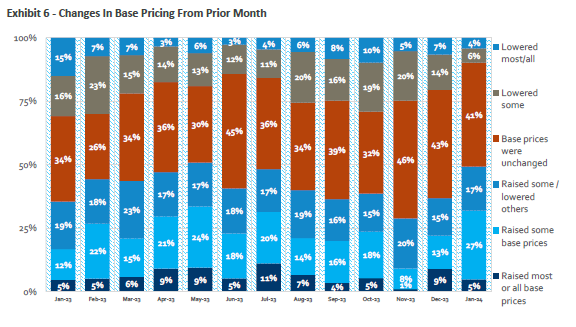

January saw an uptick in pricing. Thirty-two percent of builder respondents reported raising base prices. And despite aggressive incentive activity by public builders, incentive activity by private builders remains mixed. It is likely builders will continue to keep a careful eye on prices and make adjustments according to business conditions.

The latest NAHB/Wells Fargo Housing Market Index (released Feb. 15, 2024) came in at 48.

Highlights from the latest State of the Industry Report

January sales and (especially) traffic trends improved over December. 32% of respondents reported yr/yr increases in sales orders per community vs. 28% last month and 13% in January 2023. 29% saw a yr/yr decrease in orders vs. 40% last month and 54% for the same month in 2023. 40% of builders reported an increase in yr/yr traffic at communities; 26% saw a decline vs. 23% and 39%, respectively, last month and 13% and 53%, respectively, in January 2023.

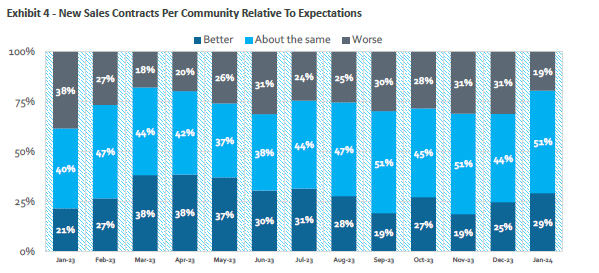

Sales and traffic performance relative to internal expectations was also a good degree better than December. 29% of respondents saw sales as better than expected; 19% saw sales as worse than expected (a better minus worse spread of +10). Last month, 25% of respondents saw sales better than expectations and 31% saw worse, for a negative spread of -6. 36% of builders saw traffic as better than expected, while 17% of builders saw traffic as worse than expected (positive spread of +19). This is improved from December (24% and 20%, respectively), a +4 spread.

Pricing activity picked up somewhat and incentive use shrank. 32% of builders reported raising either "most/all" or "some" base prices vs. 21% last month. This acceleration from December to January is fairly typical seasonally. 10% lowered "most/all" or "some" base prices. 21% reported increasing "most/all" or "some"

incentives vs. 30% last month, and 8% reported decreasing "most/all" or "some" incentives vs. 6% last month.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: