Private Builders Are Experiencing a Weakened Demand for New Homes

July 20, 2023

In the recent HomeSphere/BTIG State of the Industry Report, private builders continued to see a decrease in new home demand. With sales comps easing, stronger results were expected and there is a question if larger builders are seeing a difference too.

From the report, builders reported 27% year-over-year increase in sales orders, a decrease from 34% the previous month. Traffic remained static with builders seeing a 30% increase year-over-year and a 34% decrease. Sales and traffic expectations were weak too. Slightly more respondents saw sales as worse-than-expected than better-than-expected, however more builders saw traffic as better-than-expected than worse.

It was noted that the more positive data we're seeing for larger builders is likely due to having access to more favorable mortgage rate buydowns, and less capital availability restraints than smaller, private builders. In addition, the smaller private builder that were surveyed typically build homes at a higher price point relative to many larger public builders, who may have shifted to more lower-end products.

The latest NAHB/Wells Fargo Housing Market Index (released July 18, 2023) came in at 56, the highest reading since June 2022, suggesting public builders are still feeling confident.

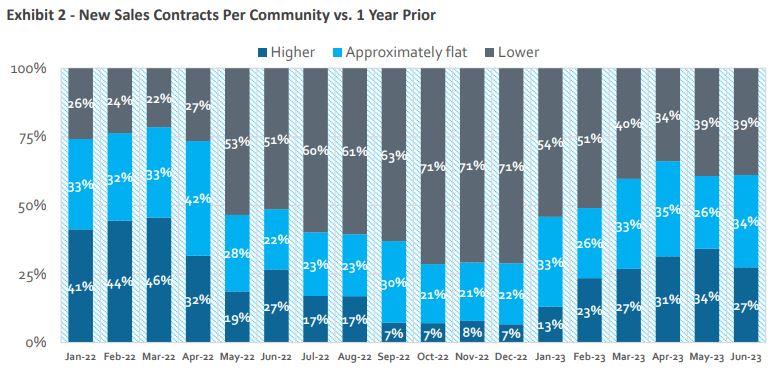

Trends in new home sales slowed in June. The number of builders reporting year-over-year growth in new contracts decreased sequentially, although the number of builders reporting a year-over-year decline in new contracts remained the same. The results are disappointing given year-over-year comparisons have eased meaningfully from the first quarter of the year and anecdotal public builder commentary has been more positive.

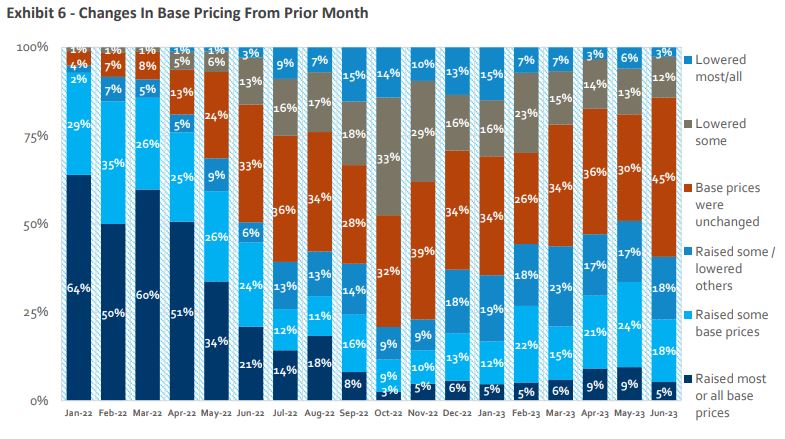

Few builders raised prices in June from May than May from April, but pricing activity overall remains mixed. In addition, incentive use is mixed, but remains somewhat elevated as 22% of respondents reported increasing incentives versus 27% last month.

BTIG analysts will continue to watch the latest activity to see how it compares to national builder data.

Highlights from the latest State of the Industry Report

Sales trends slower; traffic remains consistent sequentially. 27% of respondents reported yr/yr increases in sales orders per community vs. 34% last month and 27% in June 2022. 39% saw a yr/yr decrease in orders vs. 39% last month and 51% for the same month last year. 30% reported an increase in yr/yr traffic at communities; 34% saw a decline vs. 30% and 38%, respectively, last month.

Sales and traffic performance relative to internal expectations weakened in June. 30% of respondents saw sales as better than expected; 31% saw sales as worse than expected (negative spread of -1). Last month, 37% of respondents saw sales better than expectations and 26% saw worse (positive spread of +11). 32% of builders saw traffic as better than expected, while 26% of builders saw traffic as worse than expected (pos. spread of +6). This compares to 35% and 23%, respectively, last month (pos. spread of +12).

Builders pricing activity and the use of incentives remains mixed. 23% of builders reported raising either "most/all" or "some" base prices vs. 33% last month, while 15% of builders lowered "most/all" or "some" base prices vs. 19% last month. 22% of respondents reported increasing "most/all" or "some" incentives vs. 27% last month, while only 2% reported decreasing "most/all" or "some" incentives vs. 3% last month. We note that no builder reported decreasing "some" incentives in June.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: