Solid Momentum in the Market Despite Concerns About Tightening Credit

April 25, 2023

In this month's HomeSphere/BTIG State of the Industry Report, builders reported solid improvement in the market even with consistent credit concerns.

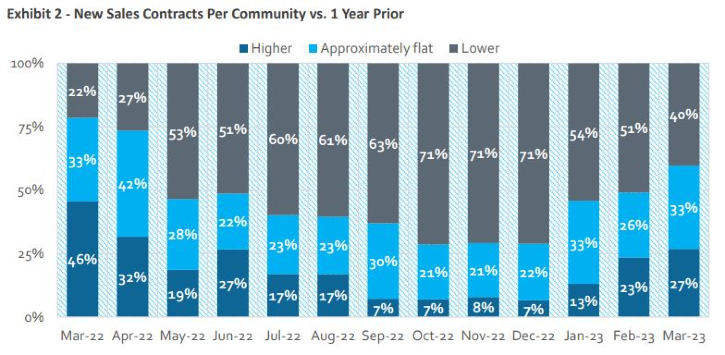

In March, 27% of builders reported year-over-year increases in sales orders per community, while 40% saw a decline, which compares to 23% and 51%, in February.

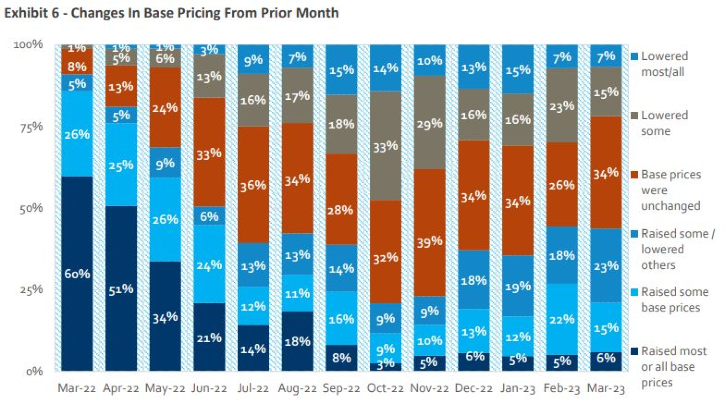

Builders left pricing unchanged in March, with 21% of builders reporting raising either "most/all" or "some" base prices compared to 27% last month and 86% at this time last year.

A special question was asked to address the recent turmoil in the U.S. regional banking industry and concerns over lending practices. Nearly half of the respondents reported their customers have expressed concern and 33% have already experienced or are likely to experience tightening of credit from lending partners. It is noted in the results gathered that responses are from small to mid-size builders who are more vulnerable to this issue than larger public builders.

Based on responses, BTIG analysts believed the NAHB/Wells Fargo Housing Market Index gauging builder sentiment would likely come in higher than the current Factset consensus expectation of 44 (the prior month reading was 40). Results matched with the index coming in at 45 for April.

Highlights from the latest State of the Industry Report

Sales and traffic trends still soft year-over-year on hard comps, but are picking up sequentially. 27% of respondents reported year-over-year increases in sales orders per community versus 23% last month and 46% in March 2022. 40% saw a year-over-year decrease in orders versus 51% last month and 22% for the same month last year. 29% reported an increase in year-over-year traffic at communities; 29% saw a decline versus 19% and 45%, respectively, last month.

Sales and traffic performance relative to internal expectations continue to meaningfully improve. 38% of respondents saw sales as better than expected; 18% saw sales as worse than expected. Last month, 27% of respondents saw sales better than expectations and 27% saw worse. 34% of builders saw traffic as better than expected, while 13% of builders saw traffic as worse than expected (27% and 20%, respectively, last month).

Builders pricing activity is mixed, while the use of incentives picked up slightly. 21% of builders reported raising either "most/all" or "some" base prices versus 27% last month, while 22% of builders lowered "most/all" or "some" base prices versus 30% last month. Incentive use increased somewhat as 27% of respondents reported increasing "most/all" or "some" incentives versus 23% last month.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: