Demand Environment Shows Slow Improvements at Start of Year

February 15, 2023

Though demand trends were still weak on a year-over-year basis in January, builder respondents indicated sequential improvement in January, according to the latest HomeSphere/BTIG State of the Industry Report.

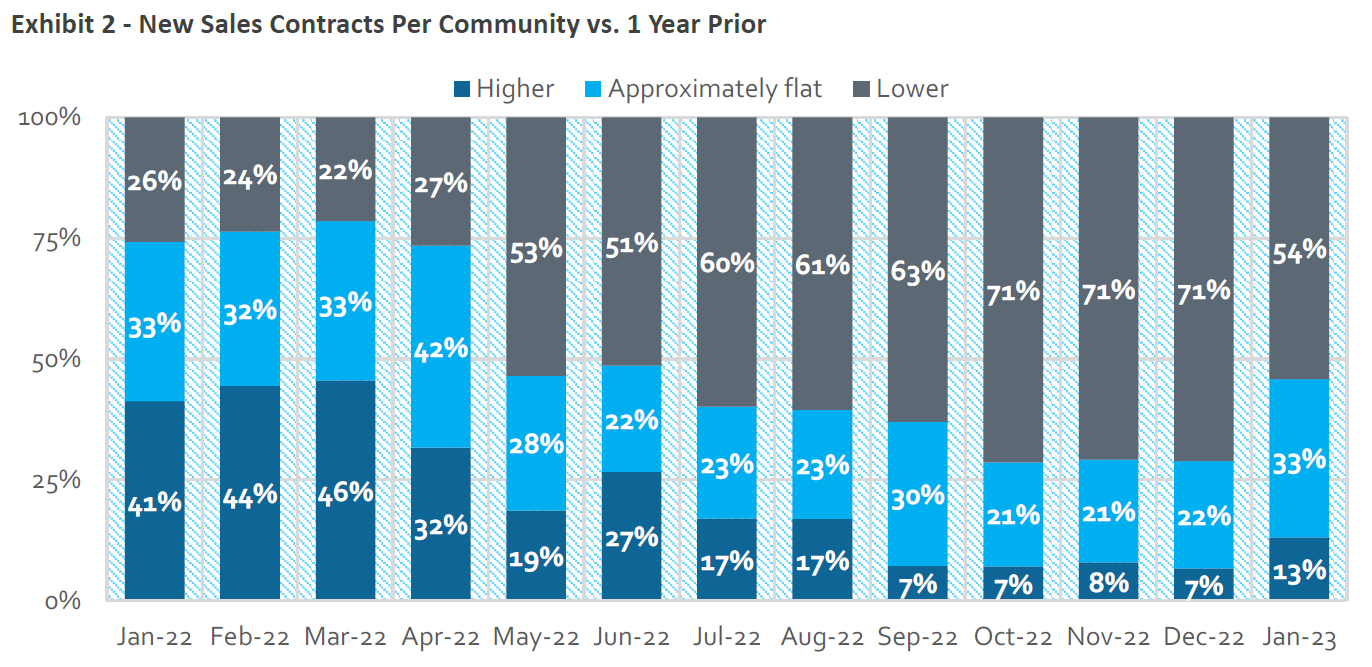

Thirteen percent of builders reported year-over-year increases in sales orders per community, while 54% saw a decline, which compares to 7% and 71%, respectively, in December.

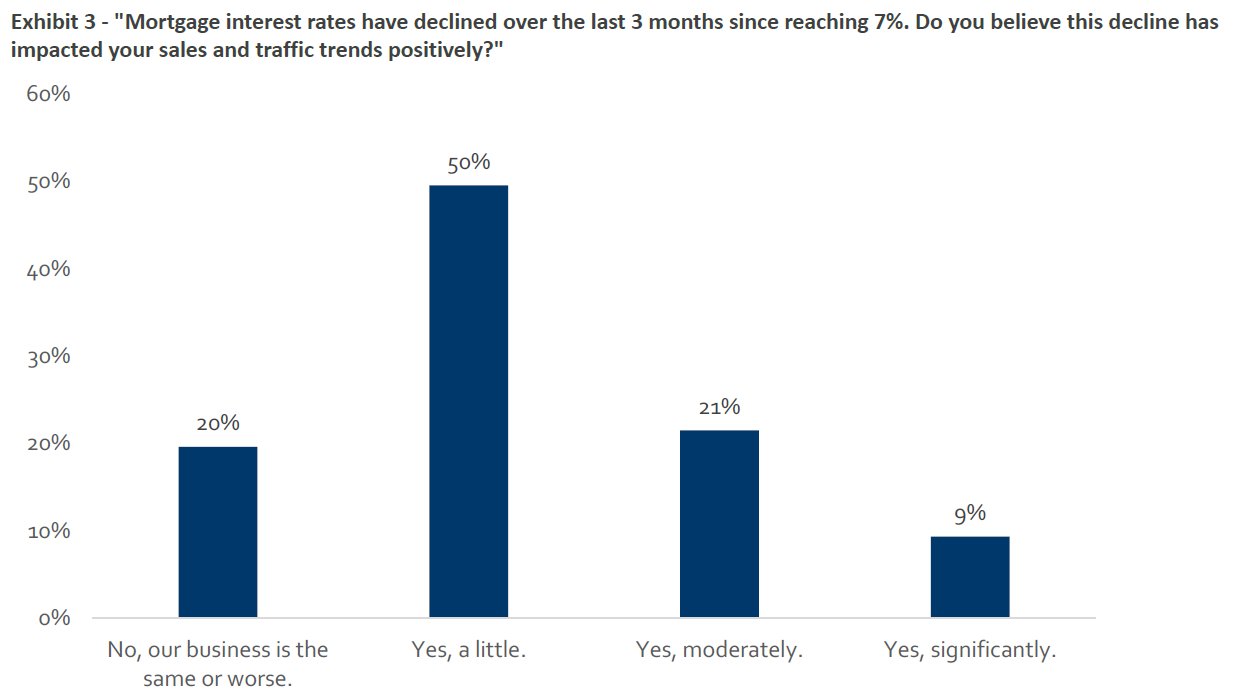

In a special question about declining mortgage rates, 80% of respondents said they believe lower rates over the last three months have had a positive impact on business. Thirty percent of total respondents believe lower rates had either a "moderate" or "significant" positive impact, while 20% indicated business is the same, or worse.

Overall, the latest report suggests business conditions continue to be sluggish overall, but the operating environment is improving heading into the spring selling season, and it’s likely the next builder confidence report will come in higher than 35.

Highlights from the latest State of the Industry Report

Sales and traffic trends still soft year-over-year on hard comps, but it’s picking up slightly sequentially. 13% of respondents reported year-over-year increases in sales orders per community versus 7% for December and 41% in January 2022. 54% saw a year-over-year decrease in orders versus 71% for December and 26% for the same month last year. 13% reported an increase in year-over-year traffic at communities, while 53% saw a decline. This compares to 10% and 70%, respectively, for December.

Sales and traffic performance relative to internal expectations remains weak, but the better-minus-worse ratio is improving. 21% of respondents saw sales as better than expected, while 38% saw sales as worse than expected (better-minus-worse ratio of -17). For December, 11% of respondents saw sales better than expectations and 34% saw worse (b-m-w ratio of -23). 19% of builders saw traffic as better than expected, while 29% of builders saw traffic as worse than expected (15% and 35%, respectively, for December, so the b-m-w ratio went to -10 from -20).

Builders continue to cut base prices and use incentives. The number of builders raising prices was relatively consistent with December as 17% of builders reported raising either "most/all" or "some" base prices versus 19% for December. 31% of builders lowered "most/all" or "some" base prices versus 29% for December. Incentive use declined but remained elevated as 30% of respondents reported increasing "most/ all" or "some" incentives (and 11% decreased some/raised others) versus 39% for December (and 9% decreased some/raised others). 6% of builders reported lowering "some" incentives versus 2% for December.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: