Builders Share Some Optimism Despite Weak Demand Environment

January 17, 2023

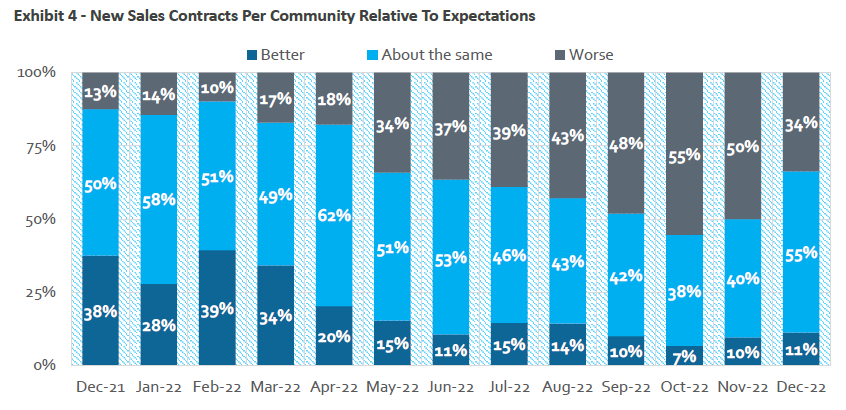

Home builder expectations improved slightly in the latest HomeSphere/BTIG State of the Industry Report, released Jan. 12. It’s likely builders are re-adjusting business plans and lowering their own expectations—11% of respondents saw sales as better than expected for December, while 34% saw sales as worse than expected. That compares to 10% and 50%, respectively, for November.

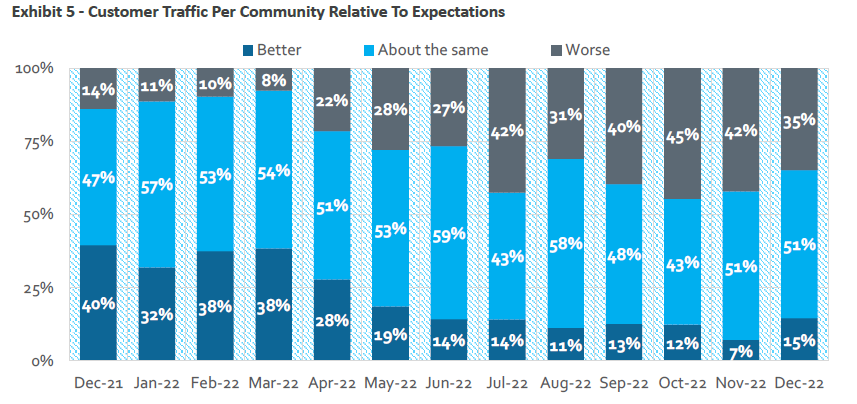

Similar improvements were seen with traffic expectations, with 15% of builders reporting traffic above expectations, while 35% reported traffic below expectations. This compares to 7% and 42%, respectively, for November.

Still, overall demand trends continued to be weak as 2022 ended, with only 7% of builders reporting year-over-year increases in sales orders per community, while 71% saw a decline. Another continued trend: the use of base price cuts and sales incentives, which remained elevated.

That being said, BTIG analysts believe the NAHB/Wells Fargo Housing Market Index, released Jan. 18, could come in slightly higher than the current Factset consensus expectation of 31 due to the slight improvement in builder expectations.

Highlights from the latest State of the Industry Report

Sales and traffic trends are still soft. Only 7% of respondents reported year-over-year increases in sales orders per community versus 8% for November and 42% in December 2021. 71% saw a year-over-year decrease in orders versus 71% for November and 25% for the same month last year. Only 10% reported an increase in year-over-year traffic at communities while 70% saw a decline. This compares to 8% and 69%, respectively, for November.

Sales and traffic performance relative to internal expectations improved slightly but remain weak. 11% of respondents saw sales as better than expected, while 34% saw sales as worse than expected. For November, 10% of respondents saw sales as better than expected and 50% saw them as worse. 15% of builders saw traffic as better than expected, while 35% of builders saw traffic as worse than expected (7% and 42%, respectively, for November). It is noted, however, that the better-minus worse ratio was at its lowest level since May for sales, and since August for traffic.

Builders continue to cut base prices and use incentives. The number of builders raising prices picked up slightly as 19% of builders reported raising either "most/all" or "some" base prices versus 15% for November. 29% of builders lowered "most/all" or "some" base prices versus 39% for November. Incentive use remained elevated as 41% of respondents reported increasing "most/all" or "some" incentives versus 40% for November. 2% of builders reported lowering "some" incentives versus 5% for November and no respondent reported lowering "most/all".

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: