New Home Demand Continues to Improve Through the Spring

May 23, 2023

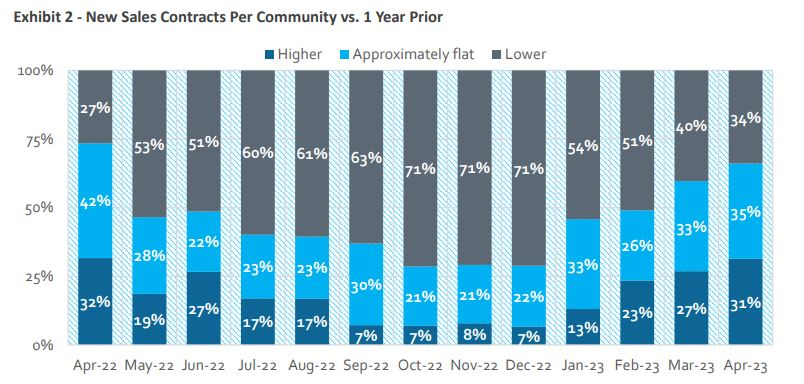

In the most recent HomeSphere/BTIG State of the Industry Report, new home demand continues to accelerate through the spring. Of the builders surveyed, 31% of the respondents reported year-over-year increase in sales orders per community versus 27% last month. In addition sales and traffic performance continue to be encouraging with 38% of respondents reporting sales as better than expected.

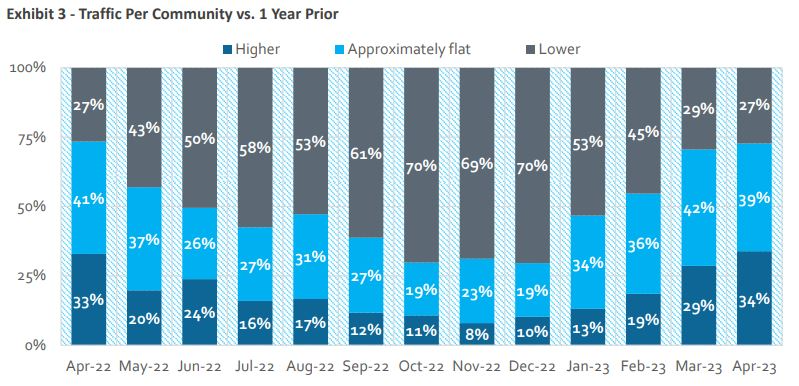

Builders also saw an improvement in traffic trends. Thirty-four percent of builders reported year-over-year growth in community traffic, compared to 29% in March and 33% in April 2022. It was noted that the traffic builders are seeing may be the result of virtual sales tools improving the overall quality of that traffic.

Based on responses, BTIG analysts believed the NAHB/Wells Fargo Housing Market Index gauging builder sentiment would likely come in higher than the current Factset consensus expectation of 45 (the prior month reading was 45). Results matched with the index coming in at 50 for May.

Highlights from the latest State of the Industry Report

Sales and traffic trends continue to pick up sequentially. 31% of respondents reported year-over-year increases in sales orders per community versus 27% last month and 32% in April 2022. 34% saw a year-over-year decrease in orders versus 40% last month and 27% for the same month last year. 34% reported an increase in year-over-year traffic at communities; 27% saw a decline versus 29% and 29%, respectively, last month. We note that year-over-year comparisons for both sales and traffic begin to significantly ease in May.

Sales and traffic performance relative to internal expectations continue to be encouraging. 38% of respondents saw sales as better than expected; 20% saw sales as worse than expected. Last month, 38% of respondents saw sales better than expectations and 18% saw worse. 42% of builders saw traffic as better than expected, while 15% of builders saw traffic as worse than expected (34% and 13%, respectively, last month).

Builders increased prices sequentially, but both pricing activity and the use of incentives remains mixed. 30% of builders reported raising either "most/all" or "some" base prices versus 21% last month, while 17% of builders lowered "most/all" or "some" base prices versus 22% last month. 22% of respondents reported increasing "most/all" or "some" incentives versus 27% last month, while 7% reported decreasing "most/all" or "some" incentives versus 10% last month.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: