Manufacturers and Suppliers Expect Declining Profit Margins in 2019

December 18, 2018

It’s not just builders who will be tightening their belts in 2019; building product manufacturers and suppliers are expected to cut back as well.

At least that’s the latest from The Z Report, a leading housing market report produced by the research firm Zelman & Associates.

According to their report, manufacturers expect a flattening of capital expenditures and decreased profit margins in 2019:

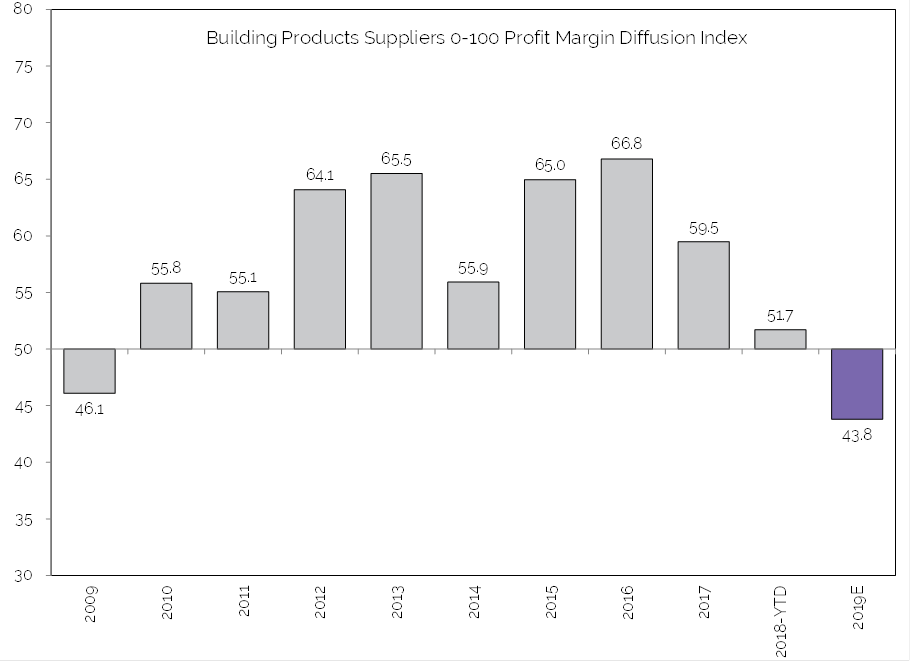

“As part of our monthly survey, we ask industry executives about current profit margin trends. Thus far in 2018, our 0-100 index has averaged 51.7, indicating slight year-over-year expansion. Putting the many cost challenges into perspective, this would be well below the trailing three-year average of 63.7 and represent the lowest annual average since 46.1 in 2009.

Likely driven by the continued challenges around raw materials, transportation costs, tariffs and labor constraints, our contacts offered a cautious tone about 2019 profit margins. Only 17% of respondents project margin expansion next year, which is shy of the 29% that predict contraction.”

The report produced by Zelman & Associates twice a month adds more insights across the industry and quantifies what you have been seeing. And from what we’ve been hearing from our builders, manufacturers, and suppliers, we are in this coming slowdown together. Builders must all begin seeking the efficiencies in all areas.

For more insight’s readers can receive a 60-day trail of The Z Report

Per The Z Report by Zelman & Associates: Proprietary Survey (read this and more)

Share This

More Building Industry Reports

Suggested Brands For You

Sorry, we couldn't find any posts. Please try a different search.