Improving Your Sales Pitch: Real Advice Straight From Home Builders

May 25, 2021

As a building product sales rep, have you ever wanted to ask a home builder for their frank opinion on how your sales pitch went — from what you got right to what you got wrong? Well, in lieu of having to do that yourself, we polled our network of home builders for their genuine thoughts on the building product pitches they hear, and we’ve compiled their answers here.

Our survey was short and simple, consisting of only three questions:

- When you’re being pitched a new product, what features are you most interested in (I.e. price, design, availability, etc.)?

- What features are you least interested in?

- What have sales reps gotten wrong in their pitches and how can they improve?

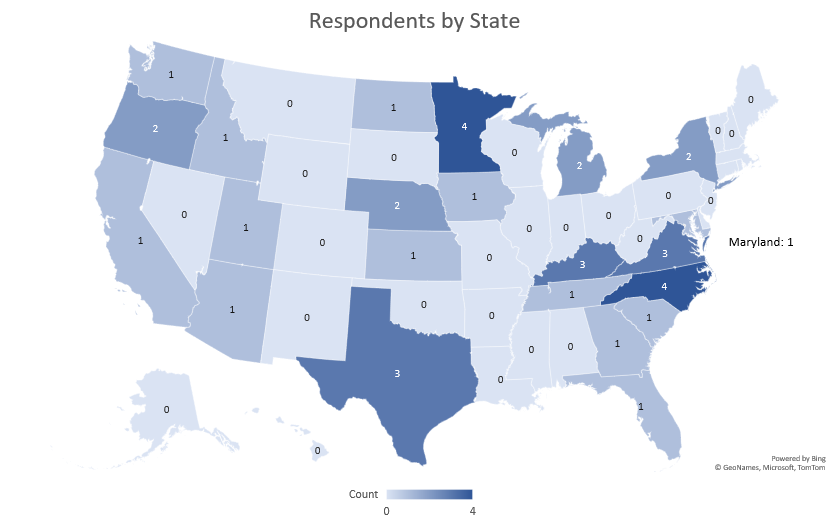

We didn’t want to influence or guess at what the answers would be, so respondents were asked to fill in their own, which means we got a large variety of answers from builders across the country. Not surprisingly, we saw the most agreement in question one. By question two the answers started to diverge and by question three, we knew we had to share all the varied insights. Keep reading for a breakdown of each question, as well as some additional tips on sales pitches from our resident experts, our regional market specialists.

Part one: What builders want to hear about your product

Is it any surprise that in our current environment, the far-and-away most mentioned features were price (1) and availability (2)?

Home builders are dealing with rising costs and disrupted supply chains, and now more than ever must be cognizant of cost and whether a product is going to slow down their timelines, so any pitch must pay respect to both these concerns.

The third most mentioned feature was design, with quality following at number four, indicating that while price and availability are forefront, builders are still interested in a good product so long as it adds value. In fact, one builder said:

“New products always interest me, as ingenuity always deserves a place at the table. I'll always look at a new product because it may soon be in demand because of its efficiency or style. Price will factor in as a final consideration.”

Furthermore, a handful of builders indicated that reputation and a product’s track record are important considerations.

Other answers included:

- Ease of install

- Durability

- How the product compares to what’s being used now

- Warranty period

- How the product helps to enhance the final product

- Brand service

- Consumer interest

- Rep responsiveness

Two builders indicated that carbon impact and sustainability are important to them in addition to factors like price, showing that builders have varied interests and there’s a niche for every product.

Meanwhile, two others also said they want to hear how a product solves a problem and be shown why they should change from what they’re already using — which is a great starting off point for a pitch that gets noticed.

Part two: What builders don’t want to hear about (at least initially)

For this question, we received more across-the-board answers that show individual preference and emphasize the importance of initial research on each builder.

We did see answers fit into some common buckets though. (Bullet points represent actual responses.)

[1] Irrelevant information:

- Fluff — stats that are inflated or inaccurate when examining the product

- Things that aren’t relevant to what’s being built

- Things that I will never use

- Technical data/specs

[2] Lack of value:

- Items that don't give a clear, perceived value to clients (but add cost)

- Anything that isn't important to buyers

- Same old, same old but with new name or price tag

[3] Anything that indicates difficulty of use:

- I.e., a limited supply of subcontractors that can use it

- Difficult installations

- Products that may be hard to service or install, or require modification of normal building practices

Not yet a HomeSphere partner?

HomeSphere manufacturer partners have access to the largest community of home builders in the U.S.

We know with the last point that some products are more complex than others, so we’d offer that in lieu of not trying to sell products that are more difficult to install, reps should be prepared to educate on why your product is worth the increased complexity.

We also like this piece of constructive criticism:

“[I’m not interested in] what the company feels are the highlights. I want to know how it differs from what I currently use and what would be gained by my use of their product.”

It’s a clear indication that while you might think you know what generally sets your product apart, builders want a highly personalized pitch.

Part three: Improving the sales pitch

From the responses we received, it’s safe to say that some of the less compelling pitches our respondents have experienced have come down to seemingly poor research and a lack of getting at the right details.

Here’s a sample of what we got back:

- “They usually do not do enough research on our business and what our target market is.”

- “There’s a lack of knowing who we are as a company and how their products can best fit in with our company.”

- “They assume they know why I might be interested and don’t ask enough questions.”

- “They don’t ask if we use a particular product, or what kind of product we’re looking for.”

Several builders also mentioned too many phone calls as a turn off, particularly without following up with informational emails, and pitching too many details at once.

But bad experiences aside, we pulled their recommendations based on good experiences for this infographic. Save the image by right-clicking on it, then choose "Save image as" before naming the file. You can also see the answers typed out below the infographic.

Sales pitch advice straight from home builders

“Make it a teaching experience, I want to learn how the product will be useful to me.”

“Get to the point: how will it benefit me, how much will it cost, what products will it replace and how difficult will it be to implement?”

“Show who else is using the product and provide references.”

“Know what you’re walking into, know what’s gone wrong and what are the successes.”

“Lift up the product and let it speak for itself.”

“Know the details of the product I’m currently using to sell me on your product.”

“Know if it can be locally supplied and installed.”

“Offer a clear value and cost presentation.”

“Use visual aids.”

“Don’t bash the competition!”

Part four: Final tips from HomeSphere experts

We also polled our own in-house experts for their advice. Our regional market specialists work with home builders and building product manufacturers every day to facilitate relationships between the two. Here are their top tips:

Don’t go on about the specifications of your products, and research builders using every tool you have including LinkedIn, Google and their websites. – Kyle Ott

Target to your strengths with purpose. Builders love when you introduce and sell something “smart” or new that they can offer to their clients, and just like you make more money/profit. Do your dealers only have a certain amount of capacity? Make sure you target appropriately. – Nate Sallach

Try reaching out through email first to gauge if there’s any true interest before calling. – John Poe

Prepare for your first pitch by driving by one of their displays and seeing what product they are currently using. – Susan Gearheart

Try to learn which competitive product the builder is using before you reach out, and sell your product based on finding a need you can fill for the builder.– Melissa Wolf

Breakdown of respondents

Webinar: Grow Revenue by Targeting Local Builders Directly

If you’re not targeting home builders already in your go-to-market strategy, watch this quick webinar to find out why you should.