Builder Sentiment Softens Amid Rising Incentives and Tariff Concerns

May 22, 2025

BTIG’s April State of the Industry report highlights mixed builder sentiment, with steady sales trends but rising concerns around buyer traffic, incentives, and the impact of newly implemented tariffs.

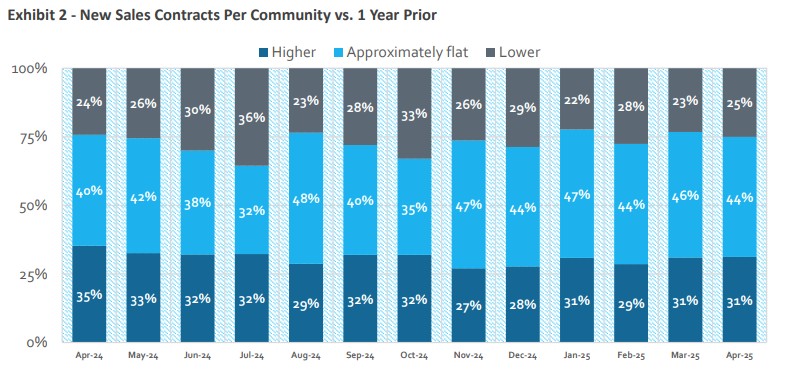

In April, builders reported steady year-over-year sales trends compared to March, with 31% seeing order growth. However, a slightly larger share reported year-over-year declines (25% vs. 23% in March), and traffic trends softened notably—only 30% saw year-over-year traffic increases, down from 36% last month, while 34% reported declines. Builder sentiment relative to expectations was mixed: more respondents reported both better- and worse-than-expected results for sales and traffic, indicating rising volatility.

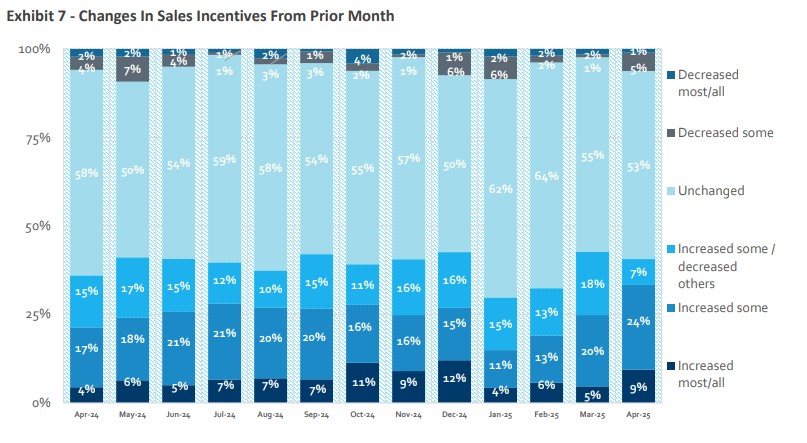

On pricing and incentives, there was an uptick in base price increases, likely driven by anticipated cost pressures, yet sales incentives also rose sharply, hitting the highest level since December 2022. Builders expressed growing concern about new tariffs, with 33% citing a modest negative impact on buyer demand and over 70% expecting some degree of negative impact on build costs. While smaller private builders reported less sales "choppiness" than public counterparts, elevated incentives and tariff-related cost worries suggest mounting headwinds. Based on this data, BTIG believes the upcoming NAHB Housing Market Index may come in below the current consensus of 40.

The latest NAHB/Wells Fargo Housing Market Index (released May 15, 2025) decreased to 34.

Highlights from the latest State of the Industry Report

Sales & traffic. Builders reported similar sales yet worse traffic trends relative to March. 31% of respondents reported yr/yr increases in sales orders, flat sequentially, and 25% saw a yr/yr decrease in orders in April vs. 23% in March. 30% of builders reported an increase in yr/yr traffic at communities while 34% saw a decline vs. 36% and 24%, respectively, last month.

Sales & traffic relative to expectations. Business relative to expectations worsened in April compared to March. 33% of respondents saw sales as better than expected (29% in March), but 29% saw sales as worse than expected vs. 20% last month, resulting in a change in the better-minus-worse spread to +4 from +9. 27% of builders saw traffic as better than expected, and 30% saw traffic as worse than expected (a better-minus-worse spread of -3). This compares to 26% better and 20% worse last month (a spread of +6).

Base pricing & incentives. The level of builders who decreased base prices in April compared to March was higher and the highest level since January; the percentage of builders who increased incentives rose month-over-month. 33% of builders reported raising either "most/all" or "some" base prices, up from 31% last month; 18% reported lowering "most/all" or "some" base prices, up sequentially from 11%. 6% reported decreasing "most/all" or "some" incentives.

Tarrifs: Demand-wise, the plurality of respondents saw the implementation of new tariffs having either a modest negative impact (33%) or no impact (32%). On costs, 51% of builders expect a modest negative impact from tariffs and 20% expect a significant negative impact. See exhibits 8-10 for further detail.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: