Builder Sentiment Improves Slightly, but Uncertainty and Incentives Rise Ahead of Tariffs

April 24, 2025

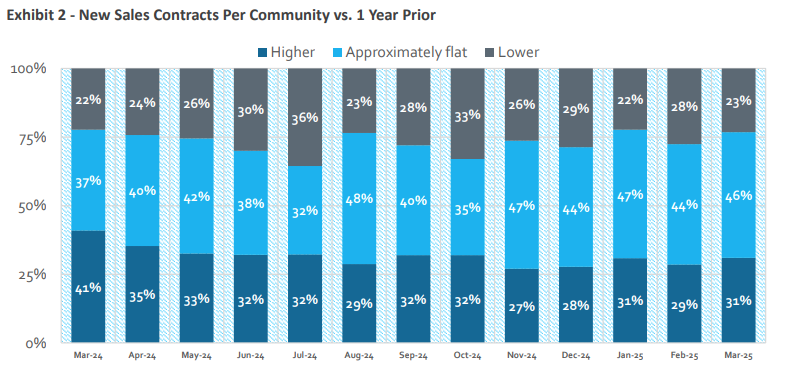

In BTIG’s State of the Industry report, released ahead of the Liberation Day tariff announcement, builder sentiment showed modest improvement with mixed signals across sales, traffic, and pricing trends. More builders reported positive year-over-year sales (31% vs. 29%) and fewer saw negative trends (23% vs. 28%). Traffic trends were stable. However, fewer builders reported sales and traffic above expectations.

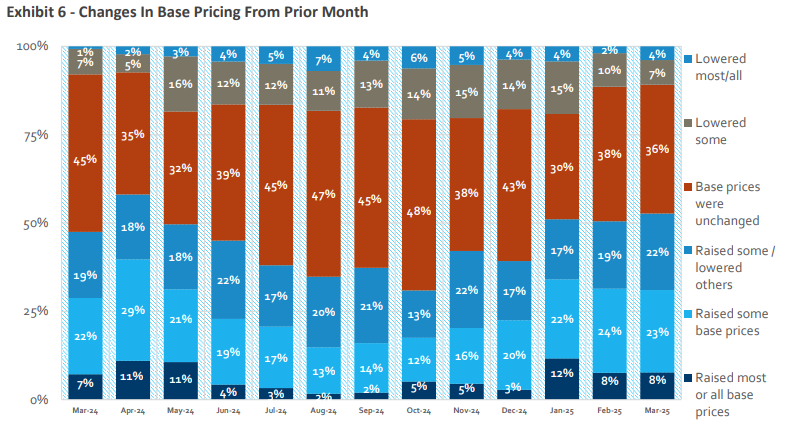

The percentage of builders raising base prices declined for the second straight month, while those increasing sales incentives rose to 25% from 19%, diverging from normal seasonal patterns. Regionally, Colorado performed well, while Virginia and Florida were more negative; Georgia and Texas were mixed, and California leaned negative. Overall, late March rate declines helped boost activity slightly, but buyers remain cautious amid macroeconomic uncertainty.

The latest NAHB/Wells Fargo Housing Market Index (released April 16, 2025) increased one point to 40.

Highlights from the latest State of the Industry Report

Sales & traffic. Builders reported better sales yet slightly worse traffic trends relative to February. 31% of respondents reported year-over-year increases in sales orders, up from 29% sequentially and 23% saw a year over year decrease in orders in March vs. 28% in February. 36% of builders reported an increase in year or year traffic at communities while 24% saw a decline vs. 37% and 24%, respectively, last month.

Sales & traffic relative to expectations. Business relative to expectations declined in March compared to February. 29% of respondents saw sales as better than expected (31% in February), but 20% saw sales as worse than expected vs. 19% last month, resulting in a change in the better-minus-worse spread to +9 from +12. 26% of builders saw traffic as better than expected, and 20% saw traffic as worse than expected (a better-minus-worse spread of +6). This compares to 29% better and 18% worse last month (a spread of +11).

Base pricing & incentives. The level of builders who decreased base prices in March compared to February was lower; the percentage of builders who increased incentives rose month-over-month. 31% of builders reported raising either "most/all" or "some" base prices, down from 32% last month; 11% reported lowering "most/all" or "some" base prices, down sequentially. 3% reported decreasing "most/all" or "some" incentives.

Regional color / interest-rate drop impact. While the small number of responses per state often makes us reticent to reach conclusions about specific markets, we note that CO builders were almost uniformly positive on their market. FL and VA builders reported weaker conditions.

HomeSphere/BTIG State of the Industry Report

HomeSphere partners with the global investment bank BTIG to create a monthly report to provide our builders and manufacturers with exclusive and timely insights about the market.

To compile the report, we survey HomeSphere’s 2,700+ regional and local home builders about sales, traffic, pricing, labor costs and other key industry metrics.

How to get the monthly report

If you are a builder and would like to participate and receive the monthly report for free, request an invitation below: